The ratio has been proven to work historically and makes sense conceptually as a valuation technique. When sales are high and costs are in check, a company like Verizon or Walmart can post enormous levels of cash. The formula for the price-to-free cash flow ratio is: Price to Free Cash Flow = Market Capitalization / Free Cash Flow. This is measured on a TTM basis and uses diluted shares outstanding. The price-to-free cash flow ratio is not the same as the price-to-cash flow ratio. The stock has gained 25.16% over the last year. For example, a company with $100 million in total operating cash flow and $50 million in capital expenditures has a free cash flow total of $50 million. Because price to free cash flow is a value metric, lower numbers generally indicate that a company is undervalued and its stock is relatively cheap in relation to its free cash flow. Lesson 7.

Companies like Verizon (VZ), Walmart (WMT), and Pfizer (PFE) also have a high free cash flow. This makes comparing P/E ratios complicated -- some industries have high earnings growth trends, which inflates a company's P/E relative to companies in other industries. Market cap of $680.57M. It is important to remember that share prices take into account expected future earnings growth. During the last 10 years free cash flow increased at an average rate of 107.22% per year.

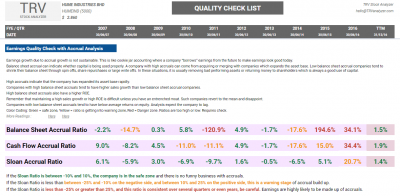

Interactive Chart: Press Play to see how analyst ratings have changed for the stocks mentioned above. However, it has record free cash flow in 2021 and that means it could be on a growth trajectory. A decade of research into what works in stock markets, Millions of pounds of platform investment, Access to hundreds of educational articles and ebooks, Over 30 talented professionals working flat out for you, A team of the very best bloggers acting as mentors, Saving you thousands in advisory fees every year. Exhibiting strong upside momentum--currently trading 6.87% above its SMA20, 11.26% above its SMA50, and 21.16% above its SMA200. Skyworks Solutions, Inc., together with its subsidiaries, designs, develops, manufactures, and markets proprietary semiconductor products, including intellectual property in the United States, China, South Korea, Taiwan, Europe, the Middle East, Africa, and rest of Asia-Pacific. In this article we investigate stocks with PEG ratios under 1. Price to free cash flow ratio can be affected by companies manipulating the statement of their free cash flow on financial statements, by doing things such as preserving cash by putting off inventory purchases until after the period covered by the financial statement. Note that free cash flow (FCF) is highly dependent on a companys cash flow from operations (CFO) that, in turn, is strongly impacted by net income (excluding amortization). It is the Share Price of the company divided by its Free Cash Flow per Share. TTM diluted EPS at $1.15, MRQ book value per share at $4.86, implies a Graham number of $11.21 (vs. current price of $8.35, a potential upside of 34.3%). During the last 10 years free cash flow increased at an average rate of 20.85% per year. A low price to free cash flow suggests the companys market cap is low relative to the free cash flow its spitting off. Thus, the lower the ratio, the 'cheaper' the stock is. TTM diluted EPS at $2.26, MRQ book value per share at $21.68, implies a Graham number of $33.2 (vs. current price of $24.03, a potential upside of 38.17%). 2. Free cash flow-to-sales is a performance ratio that measures operating cash flows after the deduction of capital expenditures relative to sales. MarketCapitalization Starbucks Corporation, together with its subsidiaries, operates as a roaster, marketer, and retailer of specialty coffee worldwide. Earnings can be more easily manipulated and don't necessarily measure the true growth of a business. P/E is short for the share price relative to earnings per share (EPS). Here is a link to the original study if you'd like to see the full results. In the long term, FCF should give a pretty good idea of a companys real profitability. Paul has been a respected figure in the financial markets for more than two decades. PEG at 0.93. This ratio tells investors how many dollars they have to pay today for each dollar a company is earning, hence the name "multiples". You can take free cash flow from the cash flow statement or calculate it on your own. The stock had a price of $96.30 at market close on Thursday June 16th. I own shares in each of these companies and have been dollar cost averaging during the current market weakness. There are investors who pay more attention to free cash flow compared to other metrics. Stockopedia is the perfect solution for the time-poor individual investor looking for results. TTM diluted EPS at $2.03, MRQ book value per share at $31.45, implies a Graham number of $37.9 (vs. current price of $21.61, a potential upside of 75.39%).

4. EPS = (Net Income - Dividends)/(Outstanding Shares). TTM diluted EPS at $1.63, MRQ book value per share at $8.32, implies a Graham number of $17.47 (vs. current price of $12.82, a potential upside of 36.26%). P/CF is used as the valuation criterion, while quality bases on operating profit and return on equity. Diluted shares outstanding increased at an average rate of 6.12% per year. The data needed to calculate a company's free cash flow is usually found on its cash flow statement. Buying Tupperware stock today could be a great idea if it can break up to a $3 billion valuation. Data on market cap/share price and a number of shares are available in stock exchange bulletins. The following names are undervalued by all three metrics. In short, the lower the price to free cash flow, the more a company's stock is considered to be a better bargain or value.

I have worked in the investment arena for over 10 years starting as an analyst and working my way up to a management role. TTM diluted EPS at $2.14, MRQ book value per share at $13.86, implies a Graham number of $25.83 (vs. current price of $19.25, a potential upside of 34.2%). The stock has lost 36.08% over the last year. A company has 2 million shares outstanding: 1. Smart Investing Bet: $1,000 in Each of These 3 Stocks. In other words, FCF measures a companys capability to generate what investors care about most: cash that can be distributed at their own discretion. In addition to being a contributor here on Seeking Alpha I publish informative videos on YouTube using the following channel https://www.youtube.com/channel/UCVh4UdktgeaPx8Ndm-j72xg.

The stock is a short squeeze candidate, with a short float at 13.38% (equivalent to 15.53 days of average volume). During this roughly 4.5 year period the DJIA had a compounded annual rate of return of 8.91% while the P/FCF selections grew at a compounded annual rate of 10.7%. Investopedia does not include all offers available in the marketplace. Based on its trailing twelve month financials the stock currently trades for a P/FCF ratio of 26.79. This is measured on a TTM basis and uses diluted shares outstanding. Based on its trailing twelve month financials the stock currently trades for a P/FCF ratio of 15.49. P/FCF at 4.51. Disclosure: I/we have a beneficial long position in the shares of ALL STOCKS MENTIONED either through stock ownership, options, or other derivatives. These are rolling 12-month periods, and that 15 number is a good rule of thumb. 9. I believe they are all high quality businesses that are currently trading for attractive prices. Free cash flow was measured as cash from operations less Capex. Confused by any of these terms? Its 5 year trailing P/FCF ratio is 32.05, and it has a long term 10 year trailing P/FCF ratio of 31.27. Additionally I wanted to test this ratio with more recent data, so I performed the same analysis between 2018 and May 2022.

How to pick stocks , Key to making money with shares. For example, let's assume that Company XYZ has 10,000,000 shares outstanding, which are trading at $3 per share. Expeditors International of Washington, Inc. provides logistics services in the Americas, North Asia, South Asia, Europe, the Middle East, Africa, and India. Some companies report high income but are unable to convert it into cash. During the last 10 years free cash flow increased at an average rate of 32.37% per year. I believe that using the price to free cash flow ratio is superior to the price to earnings ratio. Delphi Financial Group, Inc. (DFG): Life Insurance Industry. That means its still raking in sales revenues while doing what it can to reign in operating expenses. Investors should keep in mind that companies can manipulate their free cash flows, e.g., by deferring bill payments or buying goods and materials (in order to save cash). If the company's market cap value is $1 billion, then the company's stock trades at 20 times free cash flow - $1 billion / $50 million. So investors might be willing to pay a high price today if they expect a company's earnings to grow significantly in the future. I came across a 60 year study measuring the power of the price to free cash flow ratio applied to the DJIA universe of stocks. It is very similar to the price to earnings ratio but instead tells investors how many dollars they have to pay today for each dollar of free cash flow the underlying business generates. If youre looking for a company with a good price to free cash flow, you want to look for anything under 15. This post may contain affiliate links or links from our sponsors.

Stockopedia contains every insight, tool and resource you need to sort the super stocks from the falling stars. It is a calculation for the fair-value price of a stock based on its earnings per share (EPS) and most recent quarters book value per share (the value of the company's assets divided by the number of shares). The price to free cash flow metric is calculated as follows: Price to free cash flow = market capitalization value / total free cash flow amount. Many of these companies are trading for hefty valuations, so here are five stocks with low price to free cash flow levels. While these results are not as remarkable they too generated alpha over the popular index. 1. Free Cash Flow is the amount left over a company can use to pay down debt, distribute as dividends, or reinvest to grow the business. For this article we took stocks undervalued to the Graham number by more than 30%. 2020) + $15.844 (Sep. 2020) = $47.11. Using the long term trailing average P/FCF ratios the fair price for the stock is in the range of $79 to $86. Companies use this metric when they need to expand their asset bases either in order to grow their businesses or simply to maintain acceptable levels of free cash flow. Sign up for our weekly newsletter and get our most popular content delivered straight to your inbox. However, the price to free cash flow metric can also be viewed over a long-term time frame to see if the company's cash flow to share price value is generally improving or worsening. We move on to thePrice to Earnings Growth Ratio (PEG). I wrote this article myself, and it expresses my own opinions.

Stockopedia contains every insight, tool and resource you need to sort the super stocks from the falling stars. It is a calculation for the fair-value price of a stock based on its earnings per share (EPS) and most recent quarters book value per share (the value of the company's assets divided by the number of shares). The price to free cash flow metric is calculated as follows: Price to free cash flow = market capitalization value / total free cash flow amount. Many of these companies are trading for hefty valuations, so here are five stocks with low price to free cash flow levels. While these results are not as remarkable they too generated alpha over the popular index. 1. Free Cash Flow is the amount left over a company can use to pay down debt, distribute as dividends, or reinvest to grow the business. For this article we took stocks undervalued to the Graham number by more than 30%. 2020) + $15.844 (Sep. 2020) = $47.11. Using the long term trailing average P/FCF ratios the fair price for the stock is in the range of $79 to $86. Companies use this metric when they need to expand their asset bases either in order to grow their businesses or simply to maintain acceptable levels of free cash flow. Sign up for our weekly newsletter and get our most popular content delivered straight to your inbox. However, the price to free cash flow metric can also be viewed over a long-term time frame to see if the company's cash flow to share price value is generally improving or worsening. We move on to thePrice to Earnings Growth Ratio (PEG). I wrote this article myself, and it expresses my own opinions. The ratio of stock price divided by free cash flow per share (P/FCF) is often used to compare the value of companies. This is astounding and puts the ecommerce gift giant at the top of the list. Now lets calculate the trailing indicator for 12 months. Using the long term trailing average P/FCF ratios the fair price for the stock is in the range of $115 to $116. A case can be made against using the 15x multiple as a threshold for fair valuation, perhaps this ratio was fitting decades ago however today the stock market typically trades for higher multiples. Diluted shares outstanding increased at an average rate of 5.47% per year.

The company produces on average around $62 million in free cash flow through the years. Market cap of $32.49B. This guide will breakdown why free cash flow is important and how to evaluate the price comparatively. RadioShack Corp. (RSH): Electronics Stores Industry. Price to free cash flow can be manipulated on financial statements by preserving cash or putting off purchases, but its still a good measure of how a company is doing. Using the long term trailing average P/FCF ratios the fair price for the stock is in the range of $77 to $88. Visa Inc. operates as a payments technology company worldwide. It was initially part of MITs artificial intelligence lab before spinning off into its own company selling robotic vacuums and more. P/FCF at 4.1. This is a risky stock that is significantly more volatile than the overall market (beta = 2.58). Constellation Brands Inc. (STZ): Beverages Industry. Using the long term trailing average P/FCF ratios the fair price for the stock is in the range of $229 to $239.

PEG at 0.46. As alluded to above, a lower price to free cash flow is generally preferred. Equity Valuation: The Comparables Approach. Hold it long term, and you may benefit from this growth. The company facilitates digital payments among consumers, merchants, financial institutions, businesses, strategic partners, and government entities.

Learn more. Diluted shares outstanding were used to compute free cash flow per share. Over the long-term its a weighing machine, meaning that the flow of dollars buying or selling is not what determines valuation in the end but rather the companys fundamentals. Lets calculate Googles (Alphabet) Free Cash Flow for the quarter ended September 2020. By clicking Sign up, you agree to receive marketing emails from Insider During the last 10 years free cash flow increased at an average rate of 44.69% per year. 8. PEG at 0.42. In general, a stock with a high PEG ratio is considered expensive or overvalued, while a stock with a low PEG ratio is considered cheap or undervalued. Some investors will choose companies with significant free cash flow thanks to the promising future. This is a remarkable long term rate of return; however, the true impact is better visualized when applying these hypothetical returns to a monetary investment. Facebook. Higher ratios might suggest the market capitalization is lofty relative to the free cash flow spun off by the company. P/FCF at 9.32. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. How Does the Price-to-Free Cash Flow Ratio (P/FCF) Work? Using the long term trailing average P/FCF ratios the fair price for the stock is in the range of $221 to $226. The stock had a price of $89.59 at market close on Thursday June 16th. FCF 3q = CFO Capital Expenditures = $17,003$5,406 = $11,597, FCF per Share 3q = (CFO Capital Expenditures) / Shares Outstanding (Diluted Average) = ($17,003 $5,406) / 731.959 = 15.844. During the last 10 years free cash flow increased at an average rate of 30.27% per year. In fact, the price of gold and silver went up during the pandemic.

Key to making money with shares. Morgan Stanley (MS): Investment Brokerage Industry. 12-month Free Cash Flow (TTM) for the period ended in September 2020 is as follows: $8.375 (Dec. 2019) + $5.446 (Mar. This Orlando, Florida-based multi-level marketing company has long been a staple of some households. Why Do Shareholders Need Financial Statements? TTM diluted EPS at $2.46, MRQ book value per share at $15.42, implies a Graham number of $29.21 (vs. current price of $21.71, a potential upside of 34.57%). Access a thorough description of all companies mentioned2. Lesson 7.

In addition, free cash flow is similar to Warren Buffetts concept of income that he uses to value companies (The Warren Buffett Way).

10. Investors should also be aware that companies can manipulate their free cash flow by lengthening the time they take to pay the bills (thus preserving their cash), shortening the time it takes to collect what's owed to them (thus accelerating the receipt of cash), and putting off buying inventory (again thus preserving cash). Why Does the Price-to-Free Cash Flow Ratio (P/FCF) Matter. PEG at 0.85. Still, KGC stock price has been historically volatile, so theres no telling how much this nearly $10 billion company can grow from here. Stockopedia 2022, Refinitiv, Share Data Services.

How to Evaluate Firms Using Present Value of Free Cash Flows. Free cash flow to the firm (FCFF) represents the amount of cash flow from operations available for distribution after certain expenses are paid. The second way that we searched for undervalued stocks is with thePrice to Free Cash Flow Ratio (P/FCF).

Comparing the current P/FCF ratio to the trailing averages implies a potential 17% undervaluation, using the 5 year multiple, and a 16% undervaluation based on the 10 year multiple. And it has a price to free cash flow ratio of 10.1; iRobot is nearing the threshold of whats considered an appealing price to free cash flow ratio. FLWS share price almost tripled over the past year, but its still a great value when measured by the price to free cash flow method. I have no business relationship with any company whose stock is mentioned in this article. Considering buzzy app Clubhouse is valued at $4 billion despite just barely being released in the Android store, this long-time kitchen brand should be a great buy at current prices. 7. 2020) + $11.597 (Sep. 2020) = $34.02. The Price to Free Cash Flow Ratio is an excellent valuation metric for finding attractively valued companies. After all, the #1 stock is the cream of the crop, even when markets crash. Market cap of $1.34B. . If the company has exceptional financials, the markets voting machine will catch up to it in the end. Below you'll find answers to some of the most common reader questions about Price-to-Free Cash Flow Ratio (P/FCF). 3 Stocks to Buy in the Worst Market in 50 Years. Using the long term trailing average P/FCF ratios the fair price for the stock is in the range of $128 to $129. P/CF Ratio. Based on the authors finding a $10K investment in the DJIA in 1950 would increase to about $511K by the end of 2009. Analyst ratings sourced from Zacks Investment Research. The stock has had a couple of great days, gaining 9.89% over the last week. Here is a chart showing the P/FCF ratio (blue line) and the trailing 3 (green line) and 5 (gray line) year average.

Companies with high prices to free cash flow could suggest that theyre trading at elevated, and even overvalued levels. Entercom Communications Corp. (ETM): Broadcasting Industry. During the last 10 years free cash flow increased at an average rate of 30.36% per year.

Sign up for notifications from Insider! Investors often look for companies that have high or growing free cash flow but a low share price. Theres a premium multiplier involved, and that means share prices are relatively high compared to the lower free cash flow. 6. Using the long term trailing average P/FCF ratios the fair price for the stock is in the range of $104 to $108. The stock is a short squeeze candidate, with a short float at 12.8% (equivalent to 12.97 days of average volume). We've updated our Privacy Policy, which will go in to effect on September 1, 2022. This metric is very similar to the valuation metric of price to cash flowbut is considered a more exact measure, owing to the fact that it uses free cash flow, which subtracts capital expenditures (CAPEX) from a company's total operating cash flow, thereby reflecting the actual cash flow available to fund non-asset-related growth. Financhill just revealed its top stock for investors right now so there's no better time to claim your slice of the pie. Thats why you want a lower free cash flow its because the company is trading at a low multiple of cash flows. The offers that appear in this table are from partnerships from which Investopedia receives compensation. As a general rule, P/FCF under 5 (or price is less than 5 times free cash flow per share) is considered undervalued, which means the stock may be trading at too low of a price and may rise in the future to properly reflect the free cash flow generated by the firm. Based on its trailing twelve month financials the stock currently trades for a P/FCF ratio of 14.28. The first company on the list is Applied Materials that provides manufacturing equipment, services, and software to the semiconductor, display, and related industries. This ratio tells investors how many dollars they have to pay today for each dollar a company is earning, hence the name "multiples". Cash flow is the net amount of cash and cash equivalents being transferred into and out of a business. Its 5 year trailing P/FCF ratio is 20.55, and it has a long term 10 year trailing P/FCF ratio of 19.79. Price to free cash flow (P/FCF) is a valuation metric used to analyze and compare a companys per-share market price with its per-share price of free cash flow (FCF). Diluted shares outstanding decreased at an average rate of 2.39% per year.

Sign up for notifications from Insider! Investors often look for companies that have high or growing free cash flow but a low share price. Theres a premium multiplier involved, and that means share prices are relatively high compared to the lower free cash flow. 6. Using the long term trailing average P/FCF ratios the fair price for the stock is in the range of $104 to $108. The stock is a short squeeze candidate, with a short float at 12.8% (equivalent to 12.97 days of average volume). We've updated our Privacy Policy, which will go in to effect on September 1, 2022. This metric is very similar to the valuation metric of price to cash flowbut is considered a more exact measure, owing to the fact that it uses free cash flow, which subtracts capital expenditures (CAPEX) from a company's total operating cash flow, thereby reflecting the actual cash flow available to fund non-asset-related growth. Financhill just revealed its top stock for investors right now so there's no better time to claim your slice of the pie. Thats why you want a lower free cash flow its because the company is trading at a low multiple of cash flows. The offers that appear in this table are from partnerships from which Investopedia receives compensation. As a general rule, P/FCF under 5 (or price is less than 5 times free cash flow per share) is considered undervalued, which means the stock may be trading at too low of a price and may rise in the future to properly reflect the free cash flow generated by the firm. Based on its trailing twelve month financials the stock currently trades for a P/FCF ratio of 14.28. The first company on the list is Applied Materials that provides manufacturing equipment, services, and software to the semiconductor, display, and related industries. This ratio tells investors how many dollars they have to pay today for each dollar a company is earning, hence the name "multiples". Cash flow is the net amount of cash and cash equivalents being transferred into and out of a business. Its 5 year trailing P/FCF ratio is 20.55, and it has a long term 10 year trailing P/FCF ratio of 19.79. Price to free cash flow (P/FCF) is a valuation metric used to analyze and compare a companys per-share market price with its per-share price of free cash flow (FCF). Diluted shares outstanding decreased at an average rate of 2.39% per year. If a company cant generate it internally, itll have to seek help from outside investors, which will either dilute shares or boost borrowing. Because free cash flow is an indicator of success, its a plus to see it high. Tupperware Brands Corporation (NYSE:TUP) has a price to free cash flow ratio of 4.9, which is very low relative to the market as a whole. After all, top line revenues are the source of all cash that a company makes, and cash is the lifeblood of any company. How to Profit from Real Estate Without Becoming a Landlord, Robo Advisors - Here's Why 15+ Million People Have Already Opened Up Accounts, Personal Capital - Our #1 Choice for Free Financial Planning Tools, Fundrise - 23% Returns Last Year from Real Estate - Get Started with Just $10, CrowdStreet - 18.5% Average IRR from Real Estate (Accredited Investors Only). The ratio indicates how much investors are paying for a dollar of earnings. Let me show you just how well a simple P/FCF strategy has worked out historically.

I present 8 dividend growth stocks that all appear to be attractively valued using the P/FCF ratio. This is where PEG ratios become handy. We can chalk up the differences to the quality of data available and measurement techniques. If you have a question about Price-to-Free Cash Flow Ratio (P/FCF), then please ask Paul. Another method for valuing stocks is by the use of multiples, the most popular multiple is the price to earnings ratio. I wrote this article myself, and it expresses my own opinions. Our list is sorted by potential upside as calculated by the Graham number. The price-to-cash flow (P/CF) ratio measures the value of a stocks price relative to its operating cash flow per share. Comparing the current P/FCF ratio to the trailing averages implies a potential 8% undervaluation, using the 5 year multiple, and a 20% undervaluation based on the 10 year multiple. P/FCF per share = Share price / (Free Cash Flow / Shares outstanding); P/FCF = (2,000,000 * 20) / 10,000,000 = 4. In my test the DJIA had an average rate of return of 8.07% (6.77% in the original study) and a final value of about $516K for a $10K investment. iRobot Corporation (NASDAQ:IRBT) is a Bedford, Massachusetts-based consumer robot company. Its 5 year trailing P/FCF ratio is 22.52, and it has a long term 10 year trailing P/FCF ratio of 22.24. Comparing the current P/FCF ratio to the trailing averages implies a potential 12% undervaluation, using the 5 year multiple, and a 9% undervaluation based on the 10 year multiple.