Rewards are in the form of a cash credit loaded onto the card and are subject to applicable withdrawal/cash back limits. the buyers ship to address.). A Power of Attorney may be required for some Tax Audit & Notice Services. Must be a resident of the U.S., in a participating U.S. office. View step-by-step instructions for creating your account. An email will be sent to the address you provided. Then, you will upload your tax documents, and our tax pros will do the rest! Services in Texas are sometimes taxable. Available only at participating H&R Block offices. When it comes time to file sales tax in Texas you must do three things: Calculating how much sales tax you should remit to the state of Texas is easy with TaxJars Texas sales tax report. You should enable the security features on your mobile device, because anyone who has access to it will be able to view your account balance. All prices are subject to change without notice. Always ask the merchant if a surcharge applies when requesting cash back at the point of sale. If you need help handling an estate, we're here to help. Keep in mind that if you made $10,000 or more in sales tax payments to Texas in the preceding fiscal year, you are required to file and pay online.

You only have to do this once for each tax/fee and taxpayer. Other business registration fees may apply.

You only have to do this once for each tax/fee and taxpayer. Other business registration fees may apply. Only available for returns not prepared by H&R Block. The audit risk assessment is not a guarantee you will not be audited. Inc. For example, the April sales tax report is due May 20. Taxpayers who paid $500,000 or more for a specific tax in the preceding state fiscal year (Sep. 1 to Aug. 31) are required to pay using TEXNET. Read on to learn about filing statuses with H&R Block. We are experiencing higher than normal call volume. By authorizing H&R Block to e-file your tax return, or by taking the completed return to file, you are accepting the return and are obligated to pay all fees when due.

and Ingo Money, Inc., subject to the Sunrise Banks and Ingo Money Service. Fees apply.

Online AL, DC and TN do not support nonresident forms for state e-file. States. You can also: You will go to a page confirming that your account is created.

Applicants must be at least 18 years of age.

When creating a new user profile, you will need to use taxpayer and Webfile numbers to associate each tax account the employee will be working. Texas is an origin-based sales tax state. Available at participating offices and if your employer(s) participate in the W-2 Early AccessSMprogram. States assign you a filing frequency when you register for your sales tax permit. Adjust service levels where appropriate. So if you live in Texas, collecting sales tax is fairly easy. Bank products and services are offered by MetaBank, N.A. The Texas sales tax rate is 6.25%. Charge sales tax to buyers if you sell tangible goods. Coppell and other cities have taken legal action to ask the Comptroller of Public Accounts to reconsider the current proposed rules.

), Motor vehicle parking and storage services, Nonresidential real property repair, restoration or remodeling, Personal property repair, restoration or remodeling services, Taxable labor (included labor used in the process of making tangible personal property), Utility transmission and distribution services. For additional information, see our Call Tips and Peak Schedule webpage. Parents/legal guardians may apply for a permit on behalf of a minor. Valid for an original 2019 personal income tax return for our Tax Pro Go service only. Select a previously assigned account from your Card or list format. Once activated, you can view your card balance on the login screen with a tap of your finger. Southern New Hampshire University is a registered trademark in the United State and/or other countries. Void where prohibited. Heres what they have to say about that: If a seller receives an order at a place of business located outside of Texas, but delivery or shipment is made to a customer in Texas from a location within the state that is not a place of business (such as a warehouse or distribution center), the seller must collect use tax for the city, county, special purpose district or transit authority where the product is delivered if the seller is engaged in business in the jurisdiction. (Source: Texas Sales and Use Tax Bulletin, p. 11). Consult your attorney for legal advice. Read a full explanation of sales tax on shipping in Texas here. See your Cardholder Agreement for details on all ATM fees.

559, Government Code, you are entitled to review, request and correct information we have on file about you, with limited exceptions, in accordance with Ch.

For additional information, see our Call Tips and Peak Schedule webpage. Taxpayers who paid $100,000 or more must report electronically through Webfile or EDI. FEDERAL PRIVACY ACT - Disclosure of your Social Security number is required and authorized under law, for the purpose of tax administration and identification of any individual affected by applicable law, 42 U.S.C. Students will need to contact SNHU to request matriculation of credit. Additional state programs are extra. continue with the rest of the form.

See. Sales taxpayers who prepay can claim 0.5 percent for timely filing and paying, plus 1.25 percent for prepaying. Remember, Coppell, and other cities like Coppell, provide all the public services required for these warehouse operations, including police, fire protection, streets, and utilities. Economic nexus means passing a states economic threshold for total revenue or the number of transactions in that state. Select the Verify Your Email button, or paste the link into your browser. Amended tax returns not included in flat fees. Under MasterCards Zero Liability Policy, your liability for unauthorized transactions on your Card Account is $0.00 if you notify us promptly upon becoming aware of the loss or theft, and you exercise reasonable care in safeguarding your Card from loss, theft, or unauthorized use.

H&R Block Audit Representation constitutes tax advice only. An additional fee applies for online. 255 E. Parkway Blvd., P.O. Charge sales tax on services in Texas if you provide: In general, other services not mentioned here are not taxable in Texas. Try the API demo or contact Sales for filing-ready details. If you discover an error in the H&R Block tax preparation software that entitles you to a larger refund (or smaller liability), we will refund the software fees you paid to prepare that return and you may use our software to amend your return at no additional charge. By checking I Agree and selecting Continue, the account holder is agreeing to the terms and conditions of use. Enrolled Agents do not provide legal representation; signed Power of Attorney required. Limited time offer at participating locations. 2021 HRB Tax Group, Inc. See Cardholder Agreement for details. Does not provide for reimbursement of any taxes, penalties or interest imposed by taxing authorities. Texas wants sellers who made a sale into Texas from outside the state to charge sales tax based on the destination of the item (i.e. You can look up your local sales tax rate with TaxJars Sales Tax Calculator. The Texas legislature passed two bills in 2019 to address this issue. Contact each states individual department of revenue for more about registering your business. H&R Block does not provide immigration services.

There are a number of educational FAQs on obtaining a sales tax permit at the Texas Comptrollers office website. Of course, the Comptroller's office is committed to protecting your information; therefore, none of your confidential information is ever disclosed. Go through your life events checklist and see how each can affect your tax return with the experts at H&R Block. See. With this service, well match you with a tax pro with Texas tax expertise. Terms and conditions apply. The use tax rate is the same as the sales tax rate, and is explained by the Comptrollers Office, what Texas has to say about sales tax nexus, download a paper Texas sales tax permit application, North American Industrial Classification System (NAICS) code, step-by-step guide to filing your Texas sales tax returns, download a Texas Sales and Use tax return here, Another place where business is conducted, Construction services if you separately charge for materials, Internet access services (though the first $25 per account, per month is tax exempt.

View call tips and peak schedule information. Additional fees, terms and conditions apply; consult your Cardholder Agreement for details. Youll need to collect sales tax in Texas if you have nexus there. Void if sold, purchased or transferred, and where prohibited.

Rapid Reload not available in VT and WY. You can register for a Texas sales tax permit online at the Texas Comptroller of Public Accounts website here.

You can file your return and receive your refund without applying for a Refund Transfer. To complete the application, you will need the following documentation: New and renewing sales tax permittees sometimes get calls from vendors seeking to provide goods or services, but taxpayers have reported that within a week or two of starting business, the unsolicited calls diminish. See local office for pricing. General Information Letters and Private Letter Rulings, State Tax Automated Research (STAR) System, Weathering the Pandemic: Texas Industries and COVID-19, Chapter 313: Trading Tax Limitations for Development, Historically Underutilized Business (HUB), Vendor Performance Tracking System (VPTS), Texas Procurement and Contract Management Guide, Minnie Stevens Piper Foundation College Compendium, Cmo Navegar el Men Principal de Webfile, Cmo Agregar una Cuenta Fiscal por Asociaciones, Cmo Eliminar una Cuenta de Contribuyente de un Vendedor, Cmo Restablecer su Contrasea de Webfile, Cmo Presentar Impuestos sobre las Ventas siendo un Declarante de Listas, Cmo Presentar una Declaracin Modificada de Impuestos sobre las Ventas, Cmo Hacer un Pago con Cheque Electrnico en Webfile, Cmo Realizar un Pago con Tarjeta de Crdito en Webfile, Cmo encontrar su nmero de contribuyente de franquicia de 11 dgitos. H&R Block provides tax advice only through Peace of MindExtended Service Plan, Audit Assistance and Audit Representation. Form 1040EZ is generally used by single/married taxpayers with taxable income under $100,000, no dependents, no itemized deductions, and certain types of income (including wages, salaries, tips, some scholarships/grants, and unemployment compensation).

File yourself or with a small business certified tax professional. There are two ways that sellers can be tied to a state when it comes to nexus: physical or economic. A simple tax return excludes self-employment income (Schedule C), capital gains and losses (Schedule D), rental and royalty income (Schedule E), farm income (Schedule F) shareholder/partnership income or loss (Schedule K-1), and earned income credit (Schedule EIC). Type of federal return filed is based on your personal tax situation and IRS rules. So check with the Texas Comptroller if you think you may be selling taxable services. A bond may be required but only after the application is filed and reviewed. Resources TaxJar is a trademark of TPS Unlimited, Inc. Privacy Policy With the adoption of this legislation, the Texas Comptroller of Public Accounts implemented rules that go far beyond the intent of the legislation and additional policies that substantially negatively impact Coppell and many other communities. You will need to apply using form AP-201, Texas Application (PDF).

So if you live in Texas, collecting sales tax is fairly easy. You can electronically file your return and receive your refund without a RT, a loan or extra fees. Void where prohibited. Additional state programs extra. All you have to do is login. You cannot use this online application if you are a sole owner, partner, officer or director and do not have a social security number. All prices are subject to change without notice. In most states, how often you file sales tax is based on the amount of sales tax you collect from buyers in the state. Cards issued pursuant to license by Mastercard International Incorporated. Get a sneak peek of the Webfile Refresh in this short video; you'll be amazed at what's in store! During the course, should H&R Block learn of any students employment or intended employment with a competing professional tax preparation company, H&R Block reserves the right to immediately cancel the students enrollment. This approach disrupts decades of established local sales tax sourcing rules. Check cashing not available in NJ, NY, RI, VT and WY. Paying by credit card will incur a non-refundable processing fee: View proper check-writing procedures for tax payments. Form 1040EZ is generally used by single/married taxpayers with taxable income under $100,000, no dependents, no itemized deductions, and certain types of income (including wages, salaries, tips, taxable scholarships or fellowship grants, and unemployment compensation).

This is an optional tax refund-related loan from MetaBank, N.A. It is not case-sensitive. The Check-to-Card service is provided by Sunrise Banks, N.A. Your wireless carrier may charge a fee for text messaging or data usage. If you file and pay sales tax via Webfile, get ready for a streamlined experience! While we are available Monday through Friday, 8 a.m.-5 p.m. Central Time, shorter wait times normally occur from 8-10 a.m. and 4-5 p.m. If you have any questions, please contact us at 800-555-8888 or email us. An ITIN is an identification number issued by the U.S. government for tax reporting only. Results vary. H&R Block prices are ultimately determined at the time of print or e-file. Enrollment in, or completion of, the H&R Block Income Tax Course is neither an offer nor a guarantee of employment. That said, this is always subject to change. Type of federal return filed is based on taxpayer's personal situation and IRS rules/regulations. H&R Block does not automatically register hour with SNHU. With Webfile, you can file your return early and post-date the electronic check payment by changing the payment effective date. Additionally, the law prohibits us from asking requestors what they plan to do with the information.

If tax is paid over 30 days after the due date, a 10 percent penalty is assessed. Fees apply when making cash payments through MoneyGramor 7-11. General Information Letters and Private Letter Rulings, State Tax Automated Research (STAR) System, Weathering the Pandemic: Texas Industries and COVID-19, Chapter 313: Trading Tax Limitations for Development, Historically Underutilized Business (HUB), Vendor Performance Tracking System (VPTS), Texas Procurement and Contract Management Guide, Minnie Stevens Piper Foundation College Compendium. State e-file not available in NH. This number will be printed on returns and notices you receive from us in the mail. Power of Attorney required. Once you have created your account, you must gain access to the taxes/fees you wish to file and/or pay with Webfile. Getting married? Taxpayers will be notified by letter after their application for a sales tax permit has been approved whether they will file monthly or quarterly. One state program can be downloaded at no additional cost from within the program. Simple steps, easy tools, and help if you need it. Applies to individual tax returns only. A passport that doesnt have a date of entry wont be accepted as a stand-alone identification document for dependents.

Release dates vary by state. If the online tax preparation or tax software makes an arithmetic error that results in your payment of a penalty and/or interest to the IRS that you would otherwise not have been required to pay, H&R Block will reimburse you up to a maximum of $10,000. Utilize data to determine whether there are opportunities to reduce expenses. The course consists of 78 hours of instruction in Maryland, 89 hours of instruction in Oregon and 89 hours of instruction in California, University of Phoenixis a registered trademark of Apollo Group, Inc., in the United States and/or other countries. TEXNET ACH Debit payment of $1,000,000 or less, must be scheduled by 10:00 a.m. (CT) on the due date. I have read and agree to comply with the Terms of Use for TxComptroller eSystems. All Rights Reserved. Identity verification is required.

Additional fees apply with Earned Income Credit and you file any other returns such as city or local income tax returns, or if you select other products and services such as Refund Transfer. If you need help navigating your state tax obligations, get help with H&R Block Virtual! 7-ELEVEN is a registered trademark of 7-Eleven, Inc. 2015 InComm. If tax is paid 1-30 days after the due date, a 5 percent penalty is assessed. Taxpayers will be notified by letter when their business meets the threshold to be required to pay electronically via TEXNET. The Council has authorized the hiring of experts to assist with this issue, and the Mayor and City Manager have gone to Austin to testify on behalf of the City. State e-file not available in NH. Rates are for reference only; may not include all information needed for filing. Social Security number for each officer or director of a corporation. Taxpayers required to pay electronically via TEXNET must initiate their payment above $1,000,000 by 8 p.m. CT on the banking business day prior to the due date in order for the payment to be considered timely. You can do an electronic funds transfer from your bank with EDI. Transferring funds from another bank account to your Emerald Card may not be available to all cardholders and other terms and conditions apply.

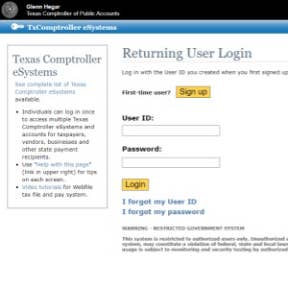

General Information Letters and Private Letter Rulings, State Tax Automated Research (STAR) System, Weathering the Pandemic: Texas Industries and COVID-19, Chapter 313: Trading Tax Limitations for Development, Historically Underutilized Business (HUB), Vendor Performance Tracking System (VPTS), Texas Procurement and Contract Management Guide, Minnie Stevens Piper Foundation College Compendium, North American Industrial Classification System (NAICS) code, you are engaged in business in Texas; and, you sell or lease tangible personal property in Texas; or. If your question is not addressed here, contact us. Print and mail or return them to one of our offices. Please log into your eSystems profile with your user ID and password. Returns filed with Webfile must be submitted by 11:59 p.m. Central Time (CT) on the due date. H&R Block does not automatically register hours with WGU. General Information Letters and Private Letter Rulings, State Tax Automated Research (STAR) System, Weathering the Pandemic: Texas Industries and COVID-19, Chapter 313: Trading Tax Limitations for Development, Historically Underutilized Business (HUB), Vendor Performance Tracking System (VPTS), Texas Procurement and Contract Management Guide, Minnie Stevens Piper Foundation College Compendium, Obtenga un adelanto de la actualizacin de. FRA2. Discount valid only for tax prep fees for an original 2017 personal income tax return prepared in a participating office. If a due date falls on a Saturday, Sunday or legal holiday, the next working day is the due date. 2017-2021 and TM, NerdWallet, Inc. All Rights Reserved. The Council and City Manager are taking a two-pronged approach to this issue. Refund Transfer is a bank deposit product, not a loan. If you are required to pay electronically, there is an additional 5% penalty for failure to do so. At participating offices. Staff has put in place a three-step analysis to best determine how to meet this objective: - Increase your productivity, customize your experience, and engage in information you care about. Approval and loan amount based on expected refund amount, eligibility criteria, and underwriting. The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis. Starting price for state returns will vary by state filed and complexity. For questions regarding electronic filing or payment, please email Electronic Reporting or call 800-442-3453.

Govt. Students will need to contact UOP to request matriculation of credit. Our purpose is to provide for the health, safety, and quality of life for our citizens, and in doing so, provide a foundation for building a better community.

by providing the taxpayers Webfile number for authentication.

This is not referring to management within your company such as the Chief Executive Officer (CEO). General Information Letters and Private Letter Rulings, State Tax Automated Research (STAR) System, Weathering the Pandemic: Texas Industries and COVID-19, Chapter 313: Trading Tax Limitations for Development, Historically Underutilized Business (HUB), Vendor Performance Tracking System (VPTS), Texas Procurement and Contract Management Guide, Minnie Stevens Piper Foundation College Compendium, Request a Certificate of Account Status or Tax Clearance Letter, The Latest Hours and Locations for Walk-in Taxpayer Service, Contingent Fee Legal Services Contract Review. The tax identity theft risk assessment will be provided in January 2019. Expires January 31, 2021. Your User ID must be 10-25 characters letters and numbers only. Box 149355 Austin, TX 78714-9355. Local taxing jurisdictions (cities, counties, special purpose districts and transit authorities) can also impose up to 2 percent sales and use tax for a maximum combined rate of 8.25 percent. Select I have read and agree to comply with the Terms of Use for TxComptroller eSystems. Western Governors University is a registered trademark in the United States and/or other countries. Permitted sales taxpayers can claim a discount of 0.5 percent of the amount of tax timely reported and paid. All tax situations are different and not everyone gets a refund.

To qualify for the H&R Block Maximum Refund Guarantee, the refund claim must be made during the calendar year in which the return was prepared and the larger refund or smaller tax liability must not be due to incomplete, inaccurate, or inconsistent information supplied by you, positions taken by you, your choice not to claim a deduction or credit, conflicting tax laws, or changes in tax laws after January 1, 2022. Mobile banking for people who want to be good with money.

SBA.gov's Business Licenses and Permits Search Tool allows you to get a listing of federal, state and local permits, licenses, and registrations you'll need to run a business. Payroll services and support to keep you compliant. Additional state programs are extra. State e-file available for $19.95. There is no tuition fee for the H&R Block Income Tax Course; however, you may be required to purchase course materials. If the filing due date falls on a weekend or holiday, sales tax is generally due the next business day. Texas corporations file number from the Texas Secretary of State. Loans are offered in amounts of $250, $500, $750, $1,250 or $3,500. Forgot Password: Select I forgot my password and enter the User ID, email address on file and the answer to the security question you chose. If you are trying to locate, download, or print Texas tax forms, you can do so on the Texas Comptroller Website, at https://comptroller.texas.gov/taxes/forms/. Comparison based on paper check mailed from the IRS. Minimum monthly payments apply. State programs can be added within the program for an additional cost. Results may vary. Terms and conditions apply. Read on to learn more about common Texas state tax forms. H&R Block online tax preparation and Tax Pro Review prices are ultimately determined at the time of print or e-file. H&R Block is a registered trademark of HRB Innovations, Inc. Emerald Cash Rewardsarecredited on a monthly basis. All Rights Reserved. E-file fees do not apply to NY state returns.

Physical nexus means having enough tangible presence or activity in a state to merit paying sales tax in that state. If you do not receive the email, check your junk or spam folder. Choose questions where you have only one clear answer. Return must be filed January 5 - February 28, 2018 at participating offices to qualify. Most state programs are available in January.

If you have no taxable sales to report, you can file by phone. A $50 penalty is assessed on each report filed after the due date. If approved, you could be eligible for a credit limit between $350 and $1,000. Use this application to register for these taxes and fees. Copyright 2021-2022 HRB Digital LLC. If you cannot respond with the valid User ID, email address, and answer to the security question please contact Electronic Reporting at 800-442-3453. RT is provided by MetaBank, N.A., Member FDIC. Why does this happen? All the information you need to file your Texas sales tax return will be waiting for you in TaxJar. Prices based on hrblock.com, turbotax.com and intuit.taxaudit.com (as of 11/28/17). 2022 TaxJar. Please have your 11-digit taxpayer number ready when you call. Fees apply if you have us file a corrected or amended return. Available at participating offices. Not valid on subsequent payments. SaaS is considered part of a data processing service in Texas and is 80% taxable and 20% exempt from sales tax. E-file fees do not apply to NY state returns. The email verification link is good for 24 hours. Your password must be 10-25 characters long, and have: Forgot User ID: Select I forgot my User ID to have your User ID sent to the email address on your account. Check cashing fees may also apply. Information about how and where those dollars are spent, featuring easy-to-use tools to track state government spending and most local government entities. A new client is defined as an individual who did not use H&R Block or Block Advisors office services to prepare his or her prior-year tax return. City staff continues to review the budget to determine how to best maintain a high level of City services and continue to operate in a conservative and responsible fiscal manner while taking into account the possibility of a substantial reduction in sales tax revenue. Power of Attorney required. Effective October 1, 2019, remote sellers with Texas revenues above $500,000 are required to register for a sales tax permit, collect sales tax on sales that ship to Texas, and remit the sales tax to the state. The City of Coppell is committed to serving the community and will continue to do so. If you receive the message The desired User ID is not available, choose a new ID. Page Last Reviewed or Updated: 05-Oct-2021, Request for Taxpayer Identification Number (TIN) and Certification, Employers engaged in a trade or business who pay compensation, Electronic Federal Tax Payment System (EFTPS), Unemployment Claim Management and Appeals, TxSmartBuy - State and Local Bid Opportunities, Business Licenses and Permits Search Tool, Treasury Inspector General for Tax Administration.