We clear millions of financial contracts a day, which means we have a key role in the world's largest economy. In aligning the QRM definition with the Consumer Financial Protection Bureaus qualified mortgage (QM) definition, regulators have responded to concerns raised in our previous comment regarding the need to balance responsible lending with preserving access to credit for creditworthy borrowers, including LMI and minority borrowers. Scarcity of CRM due to Credit risk refers to the risk that a borrower may not repay a loan and that the lender may lose the principal of the loan or the interest associated with it. regard to counterparty credit risk management. Risks Associated With Concentrations of Credit . What is Credit Risk? The default risk on a debt that arises from a borrower who fails to make the required payments is called Credit Risk. Any lender would include this as a first resort which includes principal and interest along with disruption to cash flows and the collection cost. The loss may be partial or even complete in many cases.

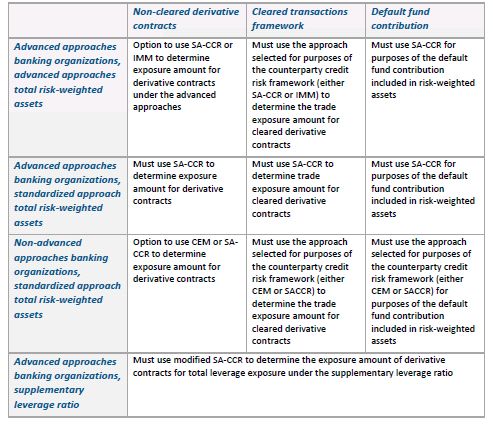

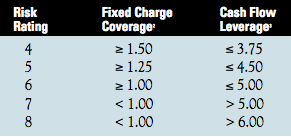

Credit risk is a specific financial risk borne by lenders when they extend credit to a borrower. This week six federal agencies (Fed, OCC, FDIC, SEC, FHFA, and HUD) finalized their joint asset-backed securities (ABS) risk retention rule. The OCC provides policy, guidance, advisories, and information about credits role in  However, there are other sources of credit risk both on and off the balance sheet. On May 8, 2020, the Federal Reserve Board (FRB), Office of the Comptroller of the Currency (OCC), Federal Deposit Insurance Corporation (FDIC) and National Credit Union Administration (NCUA) (collectively, the US bank regulatory agencies) provided the banking industry (banks, savings associations, and At inception, the loan was properly underwritten and did not possess an unwarranted level of credit riskalso the loan met the above criteria for a risk rating of Excellent, Good, or Satisfactory. The term classify within the credit union industry has typically meant individually review to apply a percentage reserve for allowance for loan and lease losses (ALLL) purposes. The Federal Reserve and Office of the Comptroller of the Currency (OCC) are issuing the attached Supervisory Guidance on Model Risk Management, which is intended for use by banking organizations and supervisors as they assess organizations management of model risk.This guidance should be applied as appropriate to all banking organizations supervised by the Credit Risk . October 26, 2020. Types of Credit RiskCredit spread risk, generated by the shifting difference between interest rates and the risk-free return rate.Default risk, occurring when borrowers become unable to make contractual payments.Downgrade risk, generated by dropping issuer risk ratings.More items i. Section 610 expands the statutory definition of loans and extensions of [] While asset quality and underwriting remain strong overall, increased competition, tighter spreads and slowing loan October 26, 2020. OCC's commercial credit division provides information and policy guidance on emerging commercial risks and supervisory issues confronting the national banking industry to promote national bank safety and soundness, as well as compliance with applicable laws and regulations. Interest rate risk from movements in interest rates. From a supervisory perspective, risk is the potential that events will have an adverse effect on a banks current or projected financial condition. on the types of high-cost credit-risk transfer structures cited in recent Basel proposals4 and a 2013 supervisory letter by the Federal Reserve.5 As noted in these statements, these structures arbitrage the risk-based capital rules to reduce risk weightings without any actual reduction in economic risk. The OCC also outlined its views on incorporating climate-related financial risks into banks' risk assessment processes, utilizing standard risk assessment principles of credit risk, liquidity risk, other financial risk, operational risk, legal/compliance risk and other nonfinancial risk. At inception, the loan was properly underwritten and did not possess an unwarranted level of credit riskalso the loan met the above criteria for a risk rating of Excellent, Good, or Satisfactory. Counterparty credit risk is the risk arising from the possibility that the counterparty may default on amounts owned on a derivative transaction. The new Definition of Default. Credit risk analysis models can be based on either financial statement analysis, default probability, or machine learning. A win for the mortgage industry: The [] A national bank or Federal savings association shall file a written safety and soundness compliance plan with the OCC within 30 days of receiving a request for a compliance plan pursuant to 30.3 (b) unless the OCC notifies the bank or savings association in writing that the plan is to be filed within a different period. In aligning the QRM definition with the Consumer Financial Protection Bureaus qualified mortgage (QM) definition, regulators have responded to concerns raised in our previous comment regarding the need to balance responsible lending with preserving access to credit for creditworthy borrowers, including LMI and minority borrowers. A formal credit risk rating system in which the ratings reflect the risk of default and credit losses, and for which a written description of the credit risk framework is maintained, including a discussion of the factors used to assign appropriate risk ratings to individual loans and retail credit portfolios, or segments thereof, with similar risk characteristics. Credit risk is the primary financial risk in the banking system and exists in virtually all income-producing activities. Risk-based capital requirement refers to a rule that establishes minimum regulatory capital for financial institutions. Sound risk management principles, including our membership standards and our margin and clearing fund requirements, are critical to OCC's ability to reduce systemic risk, increase market transparency, and provide capital and collateral efficiencies for the users of the U.S. equity options and futures markets. As the OCC identifies and assesses the risks separately. Risk exposure is a focal point of vital importance for all international markets and clearing organizations. Credit risk is the risk to earnings or capital arising from an obligor's failure to meet the terms of any contract with the bank or otherwise fail to perform as agreed.

However, there are other sources of credit risk both on and off the balance sheet. On May 8, 2020, the Federal Reserve Board (FRB), Office of the Comptroller of the Currency (OCC), Federal Deposit Insurance Corporation (FDIC) and National Credit Union Administration (NCUA) (collectively, the US bank regulatory agencies) provided the banking industry (banks, savings associations, and At inception, the loan was properly underwritten and did not possess an unwarranted level of credit riskalso the loan met the above criteria for a risk rating of Excellent, Good, or Satisfactory. The term classify within the credit union industry has typically meant individually review to apply a percentage reserve for allowance for loan and lease losses (ALLL) purposes. The Federal Reserve and Office of the Comptroller of the Currency (OCC) are issuing the attached Supervisory Guidance on Model Risk Management, which is intended for use by banking organizations and supervisors as they assess organizations management of model risk.This guidance should be applied as appropriate to all banking organizations supervised by the Credit Risk . October 26, 2020. Types of Credit RiskCredit spread risk, generated by the shifting difference between interest rates and the risk-free return rate.Default risk, occurring when borrowers become unable to make contractual payments.Downgrade risk, generated by dropping issuer risk ratings.More items i. Section 610 expands the statutory definition of loans and extensions of [] While asset quality and underwriting remain strong overall, increased competition, tighter spreads and slowing loan October 26, 2020. OCC's commercial credit division provides information and policy guidance on emerging commercial risks and supervisory issues confronting the national banking industry to promote national bank safety and soundness, as well as compliance with applicable laws and regulations. Interest rate risk from movements in interest rates. From a supervisory perspective, risk is the potential that events will have an adverse effect on a banks current or projected financial condition. on the types of high-cost credit-risk transfer structures cited in recent Basel proposals4 and a 2013 supervisory letter by the Federal Reserve.5 As noted in these statements, these structures arbitrage the risk-based capital rules to reduce risk weightings without any actual reduction in economic risk. The OCC also outlined its views on incorporating climate-related financial risks into banks' risk assessment processes, utilizing standard risk assessment principles of credit risk, liquidity risk, other financial risk, operational risk, legal/compliance risk and other nonfinancial risk. At inception, the loan was properly underwritten and did not possess an unwarranted level of credit riskalso the loan met the above criteria for a risk rating of Excellent, Good, or Satisfactory. Counterparty credit risk is the risk arising from the possibility that the counterparty may default on amounts owned on a derivative transaction. The new Definition of Default. Credit risk analysis models can be based on either financial statement analysis, default probability, or machine learning. A win for the mortgage industry: The [] A national bank or Federal savings association shall file a written safety and soundness compliance plan with the OCC within 30 days of receiving a request for a compliance plan pursuant to 30.3 (b) unless the OCC notifies the bank or savings association in writing that the plan is to be filed within a different period. In aligning the QRM definition with the Consumer Financial Protection Bureaus qualified mortgage (QM) definition, regulators have responded to concerns raised in our previous comment regarding the need to balance responsible lending with preserving access to credit for creditworthy borrowers, including LMI and minority borrowers. A formal credit risk rating system in which the ratings reflect the risk of default and credit losses, and for which a written description of the credit risk framework is maintained, including a discussion of the factors used to assign appropriate risk ratings to individual loans and retail credit portfolios, or segments thereof, with similar risk characteristics. Credit risk is the primary financial risk in the banking system and exists in virtually all income-producing activities. Risk-based capital requirement refers to a rule that establishes minimum regulatory capital for financial institutions. Sound risk management principles, including our membership standards and our margin and clearing fund requirements, are critical to OCC's ability to reduce systemic risk, increase market transparency, and provide capital and collateral efficiencies for the users of the U.S. equity options and futures markets. As the OCC identifies and assesses the risks separately. Risk exposure is a focal point of vital importance for all international markets and clearing organizations. Credit risk is the risk to earnings or capital arising from an obligor's failure to meet the terms of any contract with the bank or otherwise fail to perform as agreed.

Scarcity of CRM due to Office Of The Comptroller Of The Currency - OCC: A U.S. federal agency that serves to charter, regulate and supervise the national banks and the federal branches and agencies of foreign banks. These categories are credit risk, interest rate risk, liquidity risk, price risk, operational risk, compliance risk, strategic risk, and reputation risk. The OCC has defined eight categories of risk for bank supervision purposes: credit, interest rate, liquidity, price, As the OCC explained, when a bank sells an option that is fully paid, there is no counterparty credit risk because the bank is not entitled to anything further from the counterparty. The credit risk retention requirements became effective for securitization transactions collateralized by residential mortgages in 2015, and for other transactions in 2016. By Regulatory News.

78o11), as added by section 941 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act).1 1 Credit Risk Retention, 78 Federal Register 57,938 (Sep. 20, 2013) (Re-proposal). OCC issued the revised Concentrations of Credit booklet (Version 2.0) of the Comptrollers Handbook. Definition. - Credit risk review may be referred to as loan review, credit review, asset quality review, or another name as chosen by an institution. Credit Risk is generally defined as the risk of default of an obligor to fully meet their commitments in a timely manner. In the first section below, OCC has published the following Key Summary Statistics to assist its clearing members in calculating their exposure to OCC as a central counterparty ("CCP") arising from default fund contributions under the Basel III regulatory capital framework. The risk arises from the observation that more concentrated portfolios are less diverse and therefore the returns on the underlying assets are more correlated.. Each bank is different and may Increased competition and reduced loan growth led to a loosening of underwriting practices for the fifth year running, according to the Office of the Comptroller of the Currencys (OCC) Semiannual Risk Perspective, published in the fall of 2017. OCC manages credit risk by maintaining margin, Clearing Fund, and other resources that are sufficient to cover OCCs credit exposure to clearing members and to cover a wide range of stress scenarios that includes the default of OCCs two largest participants and their affiliates under extreme but plausible market conditions. of the banks risk governance framework. OCC issued the revised Concentrations of Credit booklet (Version 2.0) of the Comptrollers Handbook. The Foundation for Secure Markets. Credit Risk denotes a broad category of adverse financial outcomes arising from credit events (default, bankruptcy) associated with a legal entity reneging on its contractual obligations (typically for Payment) . It has been more than two and a half years since the EBA published its Guidelines on the new Definition of Default (DoD) (EBA/GL/2016/07). Federal banking, housing finance, and securities regulators have begun a review of credit risk retention rules affecting federally insured banks and thrifts that securitize residential mortgage loans. Operational risk. At inception, the loan was secured with collateral possessing a loanto-value adequate to protect the Bank from - loss. At inception, the loan was secured with collateral possessing a loanto-value adequate to protect the Bank from - loss.

As banks continue to face competitive pressures in their markets, the OCC is focusing on credit, operational and compliance risk as its top supervisory priorities, according to the agencys Semiannual Risk Perspective report released today.. Go back to Text. First Definition of models and model risk. Chicago - . The Office of the Comptroller of the Currency (OCC), the Board of Governors of the Federal Reserve System, the Federal Deposit Insurance Corporation, the U.S. Securities and Exchange Commission, the Federal Housing Finance Agency, and the U.S. Department of Housing and Urban Development (collectively, the agencies) have issued a final rule to implement the credit risk Lenders seek to manage credit risk by designing measurement tools to quantify the risk of default, then by employing mitigation strategies to minimize loan loss in the event a default does occur. (QRM) rule. that the risk profiles are substantially the same. Legal risk arises from the potential that unenforceable contracts, lawsuits, or adverse judgments can disrupt or otherwise negatively affect the operations or condition of a banking organization. 2. Credit risk is most simply defined as the potential that a bank borrower or counterparty will fail to meet its obligations in accordance with agreed terms. As expected, the final rule requires sponsors of ABS to retain an interest equal to at least 5% of the credit risk in a securitization vehicle. The nine categories of risk are: Credit risk from a debtor's failure to meet the terms of any contract with the bank or otherwise fail to perform as agreed. The federal banking agencies 1 are issuing the attached Interagency Supervisory Guidance on Counterparty Credit Risk Management.It is intended primarily for use by banking organizations with large derivatives portfolios in establishing and maintaining counterparty credit risk (CCR) management practices, as well as for supervisors as they assess and examine such Dimensions. credit unions to adopt a uniform regulatory credit grading system. 5 . For statutes, regulations, and guidance referenced in this booklet, consult those sources to determine applicability to federal savings associations. Lets take a closer look at what the OCC has to say about these two key non-financial areas of risk. The OCC, the Board, the FDIC, and the NCUA (collectively, the agencies) are inviting comment on proposed guidance for credit risk review systems. Modern economies depend on credit to finance all forms of activity, from large commercial credits to retail credit like mortgages and credit cards. oversight by the banks board of directors . Agencies update guidance on credit risk review systems | June 26, 2020. on the types of high-cost credit-risk transfer structures cited in recent Basel proposals4 and a 2013 supervisory letter by the Federal Reserve.5 As noted in these statements, these structures arbitrage the risk-based capital rules to reduce risk weightings without any actual reduction in economic risk. Credit Risk . Risk Management. Retained credit risk exposure generally may not be transferred (other than to a sponsors majority-owned affiliate), hedged, or financed by nonrecourse debt, though there are sunset timeframes after which most of these restrictions will expire. This booklet applies to the OCC's supervision of national banks and federal savings associations. As a fully integrated risk practice, we have the size and capability to address all risk issues and deliver end-to-end solutions. Managing credit and understanding associated risks are as important to consumers as they are to bankers and investors. Options Clearing Corporation - OCC: An organization that acts as both the issuer and guarantor for option and futures contracts. As described in the section discussing the front line unit definition, the OCC has made revisions to the definition of front line unit that the OCC believes addresses these concerns. 10 Federally insured credit unions must comply with 12 CFR part 723 for loans meeting the definition of member business loans. 2 OCC final guidelines footnote 2 states: These roles and responsibilities are in addition to any roles and responsibilities set forth in Appendices A, B, and C to Part 30. Title: Comptroller's Handbook "Rating Credit Risk" Author: Comptroller of the Currency Keywords: cover letter; Comptroller's Handbook; rating credit risk Compliance and Risk. State Banks: State banks that are not subject to the OCCs proposed risk governance However, credit structures themselves have continued to weaken reflecting heightened demand for leveraged credit and non-bank preferences on terms. The OCC identifies credit risk, operational risk, may be included in the definition of the borrowing base, the OCC warns against the reliance on such assets, as the inclusion of such assets in the borrowing base erodes the overall liquidity of the credit facility. As world financial derivatives markets expand and counterparty credit risk increases in size and complexity, an organization's ability to assess its exposure to credit risk has become even more critical. It is useful to enumerate some dimensions that #3 Inadequate monitoringExample A Company P borrowed $250,000 from a bank against the value of its offices. Example B Let us consider the same example Company P borrowed $250,000 from a bank against the value of its offices. Example C Company P borrows $100,000 with no collateral based on its performance.  For most banks, loans are the largest and most obvious source of credit risk. [1] In order to compete and retain customers, banks continue to ease the structure and/or terms of the loans they offer. Credit risk modeling is a technique used by lenders to determine the level of credit risk associated with extending credit to a borrower. OCC is the buyer to every seller and the seller to every buyer in the U.S. listed-options markets - in fact, we are the only company that clears and settles every listed-options trade in the country. 7 In the preamble to the final rule, the OCC clarified that options sold and fully paid for do not give rise to credit exposure for the purpose of lending limits. The OCC approach to risk management charges banks with creating a process commensurate with the level of risk, including comprehensive risk management and oversight of critical activities (such as payments, clearing, settlements, and custody) performed by third parties. The banks board is expected to oversee managements implementation of the risk management system. US regulators discuss conduct and culture. In the first quarter of 2022, MRAs were most commonly related to operational risk issues (42%) followed by credit risk (24%) and compliance risk (24%), making these essential areas of focus for financial institutions. Credit risk is a broad phenomenon as it applies to almost every conceivable economic activity. Risk-weighted assets are used to determine the minimum amount of capital that must be held by banks and other institutions to reduce the risk of insolvency . OCC notes, in particular, that many leveraged loan transactions have weak structures and cautions bank boards and management about the potential effect these loans might have on the financial system while adding that most of the credit risk associated with leveraged loans is outside the federal banking system. January 2, 2020 FDIC, OCC, The Fed 0. OCC, the world's largest equity derivatives clearing organization, today commented on the August 21 bulletin by Standard & Poor's saying that OCC's AA+/Stable credit rating remains unaffected by the approval of the company's new financial safeguards framework by the U.S. Securities and Exchange Commission. Financial Resources. The service tracks the public disclosures of over 120 banks, funds, insurers, corporates, and central counterparties as well as reports from prudential and markets regulators in Asia, Europe and North America. In addition, the definitions clarify for bankers the kinds of risk OCC will be assessing in their institutions. Banks also can manage the credit risk of their loans by selling loans directly or through loan securitization. We find that banks that securitize loans or sell loans are more likely to be net buyers of credit protection. Consequently, the various tools banks can use to reduce their credit risk appear to be complements rather than substitutes. The Office of the Comptroller of the Currency's (OCC) Comptroller's Handbook is prepared for use by OCC examiners in connection with their examination and supervision of national banks, federal savings associations, and federal branches and federal agencies of foreign banking organizations (collectively, banks). It is applied to every bank and credit union in the U.S. and is also implemented outside the U.S. by various banking supervisory regulators. The OCC finalized rules that amend Title 12, Part 5 of the CFR to provide that a national bank that is one of the 100 largest insured banks may, directly or indirectly, control a financial subsidiary or hold an interest in a financial subsidiary only if the bank has at least one issue of outstanding eligible debt that meets the applicable standard or criteria to be 1. Risk Quantum finds insights in data. Concentration risk is usually monitored by risk functions, This proposed guidance is relevant to all institutions supervised by the agencies. Concentration risk is a banking term describing the level of risk in a bank's portfolio arising from concentration to a single counterparty, sector or country.. Credit risk arises from the potential that a borrower or counterparty will fail to perform on an obligation. Loan or debt management. How a bank selects and manages its credit risk is critically important to its performance over time; indeed, capital depletion through loan losses has been the proximate cause of most institution failures. In accordance In its Fall 2019 Semiannual Risk Perspective, the Office of the Comptroller of the Currency (OCC) highlights operational, credit and interest rate risks among key risk themes posing threats to the financial institutions it regulates. More information. The CELS ratings or CAMELS rating is a supervisory rating system originally developed in the U.S. to classify a bank's overall condition. Detecting Red Flags in Board Reports: A Guide for Directors Derivatives are financial instruments that derive their value from the performance of assets, interest or currency exchange rates, or indexes. December 6, 2021 . counterparty or credit risk, currency or foreign exchange risk, market risk, and interest rate risk. The OCC highlights the primary risks that arise in developing and introducing new activities, consisting of strategic risk, reputational risk, credit risk, operational risk, compliance risk, and liquidity risk. and resilience. Currency (OCC), the Federal Reserve Board (Federal Reserve), and the Federal Deposit Insurance Corporation (FDIC) (collectively, federal banking agencies) for calculating risk-based capital requirements for retail credit risk exposures. A credit union should apply an internal loan grade based on its evaluation of credit risk. By Regulatory News. publishing the Supervisory Guidance on Model Risk Management (OCC 2011-12/SR11-7), demanding that banks use a new set of credit risk models; these models must be developed, deployed and maintained, Risk profiles may be considered substantially the same when the bank holds 95% or more of the company consolidated assets, managed assets, and off-balance sheet exposures. risk governance framework; and The .

For most banks, loans are the largest and most obvious source of credit risk. [1] In order to compete and retain customers, banks continue to ease the structure and/or terms of the loans they offer. Credit risk modeling is a technique used by lenders to determine the level of credit risk associated with extending credit to a borrower. OCC is the buyer to every seller and the seller to every buyer in the U.S. listed-options markets - in fact, we are the only company that clears and settles every listed-options trade in the country. 7 In the preamble to the final rule, the OCC clarified that options sold and fully paid for do not give rise to credit exposure for the purpose of lending limits. The OCC approach to risk management charges banks with creating a process commensurate with the level of risk, including comprehensive risk management and oversight of critical activities (such as payments, clearing, settlements, and custody) performed by third parties. The banks board is expected to oversee managements implementation of the risk management system. US regulators discuss conduct and culture. In the first quarter of 2022, MRAs were most commonly related to operational risk issues (42%) followed by credit risk (24%) and compliance risk (24%), making these essential areas of focus for financial institutions. Credit risk is a broad phenomenon as it applies to almost every conceivable economic activity. Risk-weighted assets are used to determine the minimum amount of capital that must be held by banks and other institutions to reduce the risk of insolvency . OCC notes, in particular, that many leveraged loan transactions have weak structures and cautions bank boards and management about the potential effect these loans might have on the financial system while adding that most of the credit risk associated with leveraged loans is outside the federal banking system. January 2, 2020 FDIC, OCC, The Fed 0. OCC, the world's largest equity derivatives clearing organization, today commented on the August 21 bulletin by Standard & Poor's saying that OCC's AA+/Stable credit rating remains unaffected by the approval of the company's new financial safeguards framework by the U.S. Securities and Exchange Commission. Financial Resources. The service tracks the public disclosures of over 120 banks, funds, insurers, corporates, and central counterparties as well as reports from prudential and markets regulators in Asia, Europe and North America. In addition, the definitions clarify for bankers the kinds of risk OCC will be assessing in their institutions. Banks also can manage the credit risk of their loans by selling loans directly or through loan securitization. We find that banks that securitize loans or sell loans are more likely to be net buyers of credit protection. Consequently, the various tools banks can use to reduce their credit risk appear to be complements rather than substitutes. The Office of the Comptroller of the Currency's (OCC) Comptroller's Handbook is prepared for use by OCC examiners in connection with their examination and supervision of national banks, federal savings associations, and federal branches and federal agencies of foreign banking organizations (collectively, banks). It is applied to every bank and credit union in the U.S. and is also implemented outside the U.S. by various banking supervisory regulators. The OCC finalized rules that amend Title 12, Part 5 of the CFR to provide that a national bank that is one of the 100 largest insured banks may, directly or indirectly, control a financial subsidiary or hold an interest in a financial subsidiary only if the bank has at least one issue of outstanding eligible debt that meets the applicable standard or criteria to be 1. Risk Quantum finds insights in data. Concentration risk is usually monitored by risk functions, This proposed guidance is relevant to all institutions supervised by the agencies. Concentration risk is a banking term describing the level of risk in a bank's portfolio arising from concentration to a single counterparty, sector or country.. Credit risk arises from the potential that a borrower or counterparty will fail to perform on an obligation. Loan or debt management. How a bank selects and manages its credit risk is critically important to its performance over time; indeed, capital depletion through loan losses has been the proximate cause of most institution failures. In accordance In its Fall 2019 Semiannual Risk Perspective, the Office of the Comptroller of the Currency (OCC) highlights operational, credit and interest rate risks among key risk themes posing threats to the financial institutions it regulates. More information. The CELS ratings or CAMELS rating is a supervisory rating system originally developed in the U.S. to classify a bank's overall condition. Detecting Red Flags in Board Reports: A Guide for Directors Derivatives are financial instruments that derive their value from the performance of assets, interest or currency exchange rates, or indexes. December 6, 2021 . counterparty or credit risk, currency or foreign exchange risk, market risk, and interest rate risk. The OCC highlights the primary risks that arise in developing and introducing new activities, consisting of strategic risk, reputational risk, credit risk, operational risk, compliance risk, and liquidity risk. and resilience. Currency (OCC), the Federal Reserve Board (Federal Reserve), and the Federal Deposit Insurance Corporation (FDIC) (collectively, federal banking agencies) for calculating risk-based capital requirements for retail credit risk exposures. A credit union should apply an internal loan grade based on its evaluation of credit risk. By Regulatory News. publishing the Supervisory Guidance on Model Risk Management (OCC 2011-12/SR11-7), demanding that banks use a new set of credit risk models; these models must be developed, deployed and maintained, Risk profiles may be considered substantially the same when the bank holds 95% or more of the company consolidated assets, managed assets, and off-balance sheet exposures. risk governance framework; and The .

The agencies said they would accept public comments until Feb. 3.  The goal of credit risk management is to maximise a banks risk-adjusted rate of return by maintaining credit risk exposure within acceptable parameters. The Office of the Comptroller of the Currency (OCC) is the primary regulator of banks chartered under the National Bank Act (12 USC 1 et seq.) The Report sets forth the OCC's views on the economy, as well as key supervisory and compliance risks In This Section Accounts Receivable and Inventory Financing Many of the risk management practices established and maintained by a covered bank to meet these standards, including loan review and credit underwriting and administration The Office of the Comptroller of the Currency (OCC) the primary federal bank regulator for a broad cross-section of U.S. banks, from community banks to the largest banks in the country issued its Semiannual Risk Perspective (the Report) on June 29, 2020. Copy: RQ7935186 - RCB Bank HP - Infogram. 1 OCC News release.

The goal of credit risk management is to maximise a banks risk-adjusted rate of return by maintaining credit risk exposure within acceptable parameters. The Office of the Comptroller of the Currency (OCC) is the primary regulator of banks chartered under the National Bank Act (12 USC 1 et seq.) The Report sets forth the OCC's views on the economy, as well as key supervisory and compliance risks In This Section Accounts Receivable and Inventory Financing Many of the risk management practices established and maintained by a covered bank to meet these standards, including loan review and credit underwriting and administration The Office of the Comptroller of the Currency (OCC) the primary federal bank regulator for a broad cross-section of U.S. banks, from community banks to the largest banks in the country issued its Semiannual Risk Perspective (the Report) on June 29, 2020. Copy: RQ7935186 - RCB Bank HP - Infogram. 1 OCC News release.  11 Refer to OCC Bulletin 2001--47--Third-Party Relationships and AL 2000--9--Third-Party Risk (OCC). (QRM) rule. and federal savings associations chartered under the Home Owners Loan Act of 1933 (12 USC 1461 et seq.). Credit risk is the risk to current or projected financial condition and resilience arising from an obligors failure to meet the terms of any contract with the bank or otherwise perform as agreed. The lengthy bulletin describes a life cycle process that includes: Credit risk is found in all activities where success depends on counterparty, issuer, or borrower performance.

11 Refer to OCC Bulletin 2001--47--Third-Party Relationships and AL 2000--9--Third-Party Risk (OCC). (QRM) rule. and federal savings associations chartered under the Home Owners Loan Act of 1933 (12 USC 1461 et seq.). Credit risk is the risk to current or projected financial condition and resilience arising from an obligors failure to meet the terms of any contract with the bank or otherwise perform as agreed. The lengthy bulletin describes a life cycle process that includes: Credit risk is found in all activities where success depends on counterparty, issuer, or borrower performance.