Organizations may also refer to this as net income after tax if it doesn't have any debt. These variables can be qualitative or quantitative.  ) Companies' profit after taxes is obtained and examined to create reports that allow for healthy comparison and analysis amongst companies. For example, it may purchase them to prevent competitors from doing so to gain a controlling equity stake, or it may think shares are trading at a lower rate and purchase them, potentially create more shareholder value before investing in its internal projects. Net operating profit after tax (NOPAT) is a financial measure that shows how well a company performed through its core operations, net of taxes.

) Companies' profit after taxes is obtained and examined to create reports that allow for healthy comparison and analysis amongst companies. For example, it may purchase them to prevent competitors from doing so to gain a controlling equity stake, or it may think shares are trading at a lower rate and purchase them, potentially create more shareholder value before investing in its internal projects. Net operating profit after tax (NOPAT) is a financial measure that shows how well a company performed through its core operations, net of taxes.  Ans: Read our, How To Calculate Net Profit After Tax (With Example), How To Calculate Value Added (With Examples). If the investors see the organization investing its own profits, it may believe the organization has positive net value projects in its pipeline, indicating potential further returns on their investments in the future. Net profit after tax requires knowing the operating income. Similarly, analysts may use net profit after tax to complete other cash flow calculations. Assume your company earned 4,00,000 in net profit last year and 4,80,000 this year. Analysts compare this year's PAT to last year's PAT, this quarter to last quarter, or this quarter to the similar quarter the previous year. Investopedia does not include all offers available in the marketplace. For example, if the operating income is $10,000 and the result of the tax rate equation is 0.50, the net profit after tax is $5,000. level. Financial measurements like net profit after tax provide an easy-to-understand way to evaluate an organization's profits within a specific time period. A high PAT number indicates strong efficacy and can entice more investors to acquire stock. Now is the time to give it a shot! Profit after Tax is a financial ratio used by both investors and creditors to determine whether a company's activities are profitable or not. We are always available to address the needs of our users.+91-9606800800. PAT is the most important feature of any corporation because it defines the future of the company. with economic value added (EVA). Related: .css-1v152rs{border-radius:0;color:#2557a7;font-family:"Noto Sans","Helvetica Neue","Helvetica","Arial","Liberation Sans","Roboto","Noto",sans-serif;-webkit-text-decoration:none;text-decoration:none;-webkit-transition:border-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),background-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),opacity 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-style 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-width 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-radius 200ms cubic-bezier(0.645, 0.045, 0.355, 1),box-shadow 200ms cubic-bezier(0.645, 0.045, 0.355, 1),color 200ms cubic-bezier(0.645, 0.045, 0.355, 1);transition:border-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),background-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),opacity 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-style 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-width 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-radius 200ms cubic-bezier(0.645, 0.045, 0.355, 1),box-shadow 200ms cubic-bezier(0.645, 0.045, 0.355, 1),color 200ms cubic-bezier(0.645, 0.045, 0.355, 1);border-bottom:1px solid;cursor:pointer;}.css-1v152rs:hover{color:#164081;}.css-1v152rs:active{color:#0d2d5e;}.css-1v152rs:focus{outline:none;border-bottom:1px solid;border-bottom-color:transparent;border-radius:4px;box-shadow:0 0 0 1px;}.css-1v152rs:focus:not([data-focus-visible-added]){box-shadow:none;border-bottom:1px solid;border-radius:0;}.css-1v152rs:hover,.css-1v152rs:active{color:#164081;}.css-1v152rs:visited{color:#2557a7;}@media (prefers-reduced-motion: reduce){.css-1v152rs{-webkit-transition:none;transition:none;}}.css-1v152rs:focus:active:not([data-focus-visible-added]){box-shadow:none;border-bottom:1px solid;border-radius:0;}Gross Profit vs. Net Profit: What Is the Difference?.css-r5jz5s{width:1.5rem;height:1.5rem;color:inherit;display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;-webkit-flex:0 0 auto;-ms-flex:0 0 auto;flex:0 0 auto;height:1em;width:1em;margin:0 0 0.25rem 0.25rem;vertical-align:middle;}. Change it from a percentage to a decimal point by dividing it by 100. Because the denominator represents the number of outstanding shares, any decrease in that number, even a slight increase in the numerator, can have an inverse effect on the EPS. 1 PAT aids in determining the health of a company. To obtain cash for specific government expenditures, governments levy forced taxes on persons or organizations. In year 2, the PAT rises to 120 crores and the company issues a bonus issue in the ratio of 1:1, bringing the total number of shares outstanding to 20 crores. These factors include the sale of a product, market share value, successful advertising, changes in client preferences, firm leadership, employee training programs, sales incentive programs, seasonal variations, advertising level and effectiveness, and market competition strength. Cost of goods sold

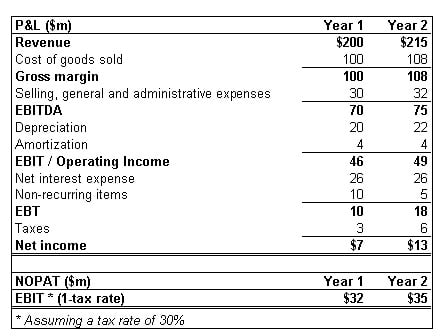

Due to a rise in the number of shares issued by the corporation, a company with increased profits/PAT may have a lower EPS than previous results. EBITDA, or earnings before interest, taxes, depreciation, and amortization, is a measure of a companys overall financial performance. Grossprofitslessoperatingexpenses NOPAT is frequently used in economic value added (EVA) calculations and is a more accurate look at operating efficiency for leveraged companies. Q: Why does a company's EPS drop while its PAT increases? (Plus How To Pursue This Degree), How To Create a Project Management Calendar in 5 Steps, ECPM: Definition, Importance and How To Calculate, How To Build Trust as a Manager (Plus Tips). For example, if a tax rate is 20%, it will become 0.20, then you will subtract it from one for a result of 0.80. However, it's important to be cautious because some investors may view dividend payouts as a sign that the organization has few to no positive net present value projects in its pipeline. Also read:What is the List of Accounting Standard. How To Calculate Net Income: Formula Plus Examples, What Are Retained Earnings?

Ans: Read our, How To Calculate Net Profit After Tax (With Example), How To Calculate Value Added (With Examples). If the investors see the organization investing its own profits, it may believe the organization has positive net value projects in its pipeline, indicating potential further returns on their investments in the future. Net profit after tax requires knowing the operating income. Similarly, analysts may use net profit after tax to complete other cash flow calculations. Assume your company earned 4,00,000 in net profit last year and 4,80,000 this year. Analysts compare this year's PAT to last year's PAT, this quarter to last quarter, or this quarter to the similar quarter the previous year. Investopedia does not include all offers available in the marketplace. For example, if the operating income is $10,000 and the result of the tax rate equation is 0.50, the net profit after tax is $5,000. level. Financial measurements like net profit after tax provide an easy-to-understand way to evaluate an organization's profits within a specific time period. A high PAT number indicates strong efficacy and can entice more investors to acquire stock. Now is the time to give it a shot! Profit after Tax is a financial ratio used by both investors and creditors to determine whether a company's activities are profitable or not. We are always available to address the needs of our users.+91-9606800800. PAT is the most important feature of any corporation because it defines the future of the company. with economic value added (EVA). Related: .css-1v152rs{border-radius:0;color:#2557a7;font-family:"Noto Sans","Helvetica Neue","Helvetica","Arial","Liberation Sans","Roboto","Noto",sans-serif;-webkit-text-decoration:none;text-decoration:none;-webkit-transition:border-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),background-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),opacity 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-style 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-width 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-radius 200ms cubic-bezier(0.645, 0.045, 0.355, 1),box-shadow 200ms cubic-bezier(0.645, 0.045, 0.355, 1),color 200ms cubic-bezier(0.645, 0.045, 0.355, 1);transition:border-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),background-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),opacity 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-style 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-width 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-radius 200ms cubic-bezier(0.645, 0.045, 0.355, 1),box-shadow 200ms cubic-bezier(0.645, 0.045, 0.355, 1),color 200ms cubic-bezier(0.645, 0.045, 0.355, 1);border-bottom:1px solid;cursor:pointer;}.css-1v152rs:hover{color:#164081;}.css-1v152rs:active{color:#0d2d5e;}.css-1v152rs:focus{outline:none;border-bottom:1px solid;border-bottom-color:transparent;border-radius:4px;box-shadow:0 0 0 1px;}.css-1v152rs:focus:not([data-focus-visible-added]){box-shadow:none;border-bottom:1px solid;border-radius:0;}.css-1v152rs:hover,.css-1v152rs:active{color:#164081;}.css-1v152rs:visited{color:#2557a7;}@media (prefers-reduced-motion: reduce){.css-1v152rs{-webkit-transition:none;transition:none;}}.css-1v152rs:focus:active:not([data-focus-visible-added]){box-shadow:none;border-bottom:1px solid;border-radius:0;}Gross Profit vs. Net Profit: What Is the Difference?.css-r5jz5s{width:1.5rem;height:1.5rem;color:inherit;display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;-webkit-flex:0 0 auto;-ms-flex:0 0 auto;flex:0 0 auto;height:1em;width:1em;margin:0 0 0.25rem 0.25rem;vertical-align:middle;}. Change it from a percentage to a decimal point by dividing it by 100. Because the denominator represents the number of outstanding shares, any decrease in that number, even a slight increase in the numerator, can have an inverse effect on the EPS. 1 PAT aids in determining the health of a company. To obtain cash for specific government expenditures, governments levy forced taxes on persons or organizations. In year 2, the PAT rises to 120 crores and the company issues a bonus issue in the ratio of 1:1, bringing the total number of shares outstanding to 20 crores. These factors include the sale of a product, market share value, successful advertising, changes in client preferences, firm leadership, employee training programs, sales incentive programs, seasonal variations, advertising level and effectiveness, and market competition strength. Cost of goods sold

Due to a rise in the number of shares issued by the corporation, a company with increased profits/PAT may have a lower EPS than previous results. EBITDA, or earnings before interest, taxes, depreciation, and amortization, is a measure of a companys overall financial performance. Grossprofitslessoperatingexpenses NOPAT is frequently used in economic value added (EVA) calculations and is a more accurate look at operating efficiency for leveraged companies. Q: Why does a company's EPS drop while its PAT increases? (Plus How To Pursue This Degree), How To Create a Project Management Calendar in 5 Steps, ECPM: Definition, Importance and How To Calculate, How To Build Trust as a Manager (Plus Tips). For example, if a tax rate is 20%, it will become 0.20, then you will subtract it from one for a result of 0.80. However, it's important to be cautious because some investors may view dividend payouts as a sign that the organization has few to no positive net present value projects in its pipeline. Also read:What is the List of Accounting Standard. How To Calculate Net Income: Formula Plus Examples, What Are Retained Earnings?  It includes gross profits less operating expenses, which is comprised of selling, general, and administrative (e.g., office supplies) expenses. Earnings per share, or EPS, is a key indicator that investors, shareholders, and analysts monitor. This may aid in determining the organization's development and cash flow potential in the absence of debt. This compensation may impact how and where listings appear. Peggy James is a CPA with over 9 years of experience in accounting and finance, including corporate, nonprofit, and personal finance environments. Taxation is an external component that influences the profit after tax level. Net profit after tax, or net operating profit after tax (NOPAT), is a financial measurement. Interest expense

A large profit margin translates to higher dividends for equity shareholders. It's important to convert the tax rate into a format you can use for the calculation. index also aids the company in determining whether it needs to cut costs. NOPAT does not include the tax savings many companies get because of existing debt. Profit after Tax is determined on a per-share basis if the company is publicly traded, and it appears on the income statement. to perform additional cash flow estimates. is the amount that remains after a firm has paid off all of its operating and non-operating expenses, other liabilities, and taxes. We've updated our Privacy Policy, which will go in to effect on September 1, 2022. The taxable component is not necessary in the case of a negative profit before Tax (where total expenses exceed total revenue). In addition to providing analysts with a measure of core operating efficiency without the influence of debt, mergers, and acquisitions analysts use net operating profit after tax. PAT are the line items of interest for a company's shareholders, therefore knowing what they signify and how to use them is a must when evaluating the stock's attractiveness to equity investors. The PAT analysis can also be used to determine a company's operational efficiency without having to look at its financial structure. This profit is what the corporation distributes to its shareholders as dividends or keeps as retained earnings in reserves. Dividends are distributed in direct proportion to PAT. Payment of dividends to shareholders is the company's way of sharing their profits and thanking the shareholders for their trust in the company and their support.

It includes gross profits less operating expenses, which is comprised of selling, general, and administrative (e.g., office supplies) expenses. Earnings per share, or EPS, is a key indicator that investors, shareholders, and analysts monitor. This may aid in determining the organization's development and cash flow potential in the absence of debt. This compensation may impact how and where listings appear. Peggy James is a CPA with over 9 years of experience in accounting and finance, including corporate, nonprofit, and personal finance environments. Taxation is an external component that influences the profit after tax level. Net profit after tax, or net operating profit after tax (NOPAT), is a financial measurement. Interest expense

A large profit margin translates to higher dividends for equity shareholders. It's important to convert the tax rate into a format you can use for the calculation. index also aids the company in determining whether it needs to cut costs. NOPAT does not include the tax savings many companies get because of existing debt. Profit after Tax is determined on a per-share basis if the company is publicly traded, and it appears on the income statement. to perform additional cash flow estimates. is the amount that remains after a firm has paid off all of its operating and non-operating expenses, other liabilities, and taxes. We've updated our Privacy Policy, which will go in to effect on September 1, 2022. The taxable component is not necessary in the case of a negative profit before Tax (where total expenses exceed total revenue). In addition to providing analysts with a measure of core operating efficiency without the influence of debt, mergers, and acquisitions analysts use net operating profit after tax. PAT are the line items of interest for a company's shareholders, therefore knowing what they signify and how to use them is a must when evaluating the stock's attractiveness to equity investors. The PAT analysis can also be used to determine a company's operational efficiency without having to look at its financial structure. This profit is what the corporation distributes to its shareholders as dividends or keeps as retained earnings in reserves. Dividends are distributed in direct proportion to PAT. Payment of dividends to shareholders is the company's way of sharing their profits and thanking the shareholders for their trust in the company and their support.

As a hybrid computation, it may provide information into the company's performance and operational efficiency without the influence of leverage. This profit is what the corporation distributes to its shareholders as dividends or keeps as retained earnings in reserves. statistic is negative, the company is losing money. To calculate NOPAT, the operating income, also known as the operating profit, must be determined. Ans:

is a financial ratio used by both investors and creditors to determine whether a company's activities are profitable or not. Analysts compare this year's PAT to last year's PAT, this quarter to last quarter, or this quarter to the similar quarter the previous year. As a result, we can see that an increase in the number of shares has an impact on the EPS, even though the company's PAT levels have increased. Net. In this way, it is a more accurate measure of pure operating efficiency. Overhead costs

The profit after tax index also aids the company in determining whether it needs to cut costs. How to Evaluate Firms Using Present Value of Free Cash Flows, Free Cash Flow Yield: The Best Fundamental Indicator, How to Calculate Return on Investment (ROI), How to Analyze REITs (Real Estate Investment Trusts), Understanding Net Operating Profit After Tax (NOPAT), After Tax Operating Income (ATOI) Definition, Earnings Before Interest and Taxes (EBIT): Definition and Formula, Earnings Before Interest, Taxes, Depreciation & Amortization (EBITDA) Definition. To determine the net profit after tax, they multiply $15,000 by 0.70 for a total of $10,500. As a result, we can see that an increase in the number of shares has an impact on the EPS, even though the company's PAT levels have increased. The profit after taxes for a wholesale company with. Taxes are remitted to the government on a regular basis. A rise in the number of shares may be due to the issuance of bonus shares, the splitting of shares, the exercising of stock options, or the issuance of new equity shares. It excludes the tax savings an organization may receive because of its existing debt, and it also excludes one-time losses or charges, such as charges related to an acquisition. A rise in the number of shares may be due to the issuance of bonus shares, the splitting of shares, the exercising of stock options, or the issuance of new equity shares. It's essential for organizations to monitor their profits to evaluate their success and potential for growth. These include -. Depreciated inventory can result in a reduction in profit margins, which can be detrimental to the organization. \begin{aligned} &\text{NOPAT} = \text{Operating Income} \times \left ( 1 - \text{Tax Rate} \right ) \\ &\textbf{where:} \\ &\text{Operating Income} = \text{Gross profits less operating expenses} \\ \end{aligned} This may help evaluate the organization's growth and cash flow potential without debt. Due to a rise in the number of shares issued by the corporation, a company with increased profits/PAT may have a lower EPS than previous results. = It is the excess of returns over all of the company's or business's net expenses. Ans: , net profit, or profit available to equity shareholders is referred to as PAT. Net income includes operating expenses but also includes tax savings from debt. Organizations frequently use net. NOPAT=OperatingIncome(1TaxRate)where:OperatingIncome=Grossprofitslessoperatingexpenses. Here's the formula for calculating economic free cash flow to firm: Economic free cash flow to firm = net operating profit after tax - capital, Read more: .css-1v152rs{border-radius:0;color:#2557a7;font-family:"Noto Sans","Helvetica Neue","Helvetica","Arial","Liberation Sans","Roboto","Noto",sans-serif;-webkit-text-decoration:none;text-decoration:none;-webkit-transition:border-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),background-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),opacity 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-style 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-width 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-radius 200ms cubic-bezier(0.645, 0.045, 0.355, 1),box-shadow 200ms cubic-bezier(0.645, 0.045, 0.355, 1),color 200ms cubic-bezier(0.645, 0.045, 0.355, 1);transition:border-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),background-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),opacity 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-style 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-width 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-radius 200ms cubic-bezier(0.645, 0.045, 0.355, 1),box-shadow 200ms cubic-bezier(0.645, 0.045, 0.355, 1),color 200ms cubic-bezier(0.645, 0.045, 0.355, 1);border-bottom:1px solid;cursor:pointer;}.css-1v152rs:hover{color:#164081;}.css-1v152rs:active{color:#0d2d5e;}.css-1v152rs:focus{outline:none;border-bottom:1px solid;border-bottom-color:transparent;border-radius:4px;box-shadow:0 0 0 1px;}.css-1v152rs:focus:not([data-focus-visible-added]){box-shadow:none;border-bottom:1px solid;border-radius:0;}.css-1v152rs:hover,.css-1v152rs:active{color:#164081;}.css-1v152rs:visited{color:#2557a7;}@media (prefers-reduced-motion: reduce){.css-1v152rs{-webkit-transition:none;transition:none;}}.css-1v152rs:focus:active:not([data-focus-visible-added]){box-shadow:none;border-bottom:1px solid;border-radius:0;}How To Calculate Free Cash Flow (FCF).css-r5jz5s{width:1.5rem;height:1.5rem;color:inherit;display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;-webkit-flex:0 0 auto;-ms-flex:0 0 auto;flex:0 0 auto;height:1em;width:1em;margin:0 0 0.25rem 0.25rem;vertical-align:middle;}. You get 0.2 if you divide this by last year's PAT, which was 4,00,000.

Q: What are the expenses to be deducted from net income to arrive at a profit after tax?

OperatingIncome When you multiply this number by 100, you get a net income increase of 20% over the previous year. Net operating profit after tax (NOPAT) is a company's potential cash earnings if its capitalization were unleveragedthat is, if it had no debt. An organization may decide to reinvest its net profits or income back into the organization. margin (PAT) is used to indicate how any change in the value can manipulate the stock prices. Profit after Tax is the amount that remains after a firm has paid off all of its operating and non-operating expenses, other liabilities, and taxes. Only in the case of profitability is it calculated. Also read:3 Golden Rules of Accounting, Explained with Best Examples. The accountant then converts the tax rate into a decimal, making it 0.30, and then subtracts it from one for a result of 0.70. When you multiply this number by 100, you get a net income increase of 20% over the previous year. In this article, we define what net profit after tax is, outline the steps for calculating net profit after tax, provide an example calculation and list other ways to use this financial measurement. They use this to calculate free cash flow to firm (FCFF), which equals net operating profit after tax, minus changes in working capital. If treasury stock increases, this suggests there may be a reduction in the number of shares outstanding. Subscribe to our newsletter and receive all the information about our updates and articles straight to your inbox. Install the. is an easy-to-understand financial measurement for evaluating an organization's profitability over a certain period. If the Profit after Tax statistic is negative, the company is losing money. Operating income looks at profit after deducting operating expenses such as wages, depreciation, and cost of goods sold. As a result, the money cannot be taxed. When calculating net operating profit after tax, analysts like to compare against similar companies in the same industry, because some industries have higher or lower costs than others.

Taxation continues to have a significant impact on net income. To obtain cash for specific government expenditures, governments levy forced taxes on persons or organizations. The collection of taxes is the government's primary source of revenue in India. The Net income after taxes or the profit after taxes is one of the most analysed figures in the financial statements of a company. Related: .css-1v152rs{border-radius:0;color:#2557a7;font-family:"Noto Sans","Helvetica Neue","Helvetica","Arial","Liberation Sans","Roboto","Noto",sans-serif;-webkit-text-decoration:none;text-decoration:none;-webkit-transition:border-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),background-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),opacity 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-style 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-width 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-radius 200ms cubic-bezier(0.645, 0.045, 0.355, 1),box-shadow 200ms cubic-bezier(0.645, 0.045, 0.355, 1),color 200ms cubic-bezier(0.645, 0.045, 0.355, 1);transition:border-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),background-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),opacity 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-color 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-style 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-bottom-width 200ms cubic-bezier(0.645, 0.045, 0.355, 1),border-radius 200ms cubic-bezier(0.645, 0.045, 0.355, 1),box-shadow 200ms cubic-bezier(0.645, 0.045, 0.355, 1),color 200ms cubic-bezier(0.645, 0.045, 0.355, 1);border-bottom:1px solid;cursor:pointer;}.css-1v152rs:hover{color:#164081;}.css-1v152rs:active{color:#0d2d5e;}.css-1v152rs:focus{outline:none;border-bottom:1px solid;border-bottom-color:transparent;border-radius:4px;box-shadow:0 0 0 1px;}.css-1v152rs:focus:not([data-focus-visible-added]){box-shadow:none;border-bottom:1px solid;border-radius:0;}.css-1v152rs:hover,.css-1v152rs:active{color:#164081;}.css-1v152rs:visited{color:#2557a7;}@media (prefers-reduced-motion: reduce){.css-1v152rs{-webkit-transition:none;transition:none;}}.css-1v152rs:focus:active:not([data-focus-visible-added]){box-shadow:none;border-bottom:1px solid;border-radius:0;}What Are Retained Earnings? A high PAT number indicates strong efficacy and can entice more investors to acquire stock. Firms, individuals, domestic companies, foreign companies, and so on all have different tax rates.

Both are primarily used by analysts looking for acquisition targets since the acquirer's financing will replace the current financing arrangement. Dividends may attract investors for equity ownership if they value cash flows more than they value growth prospects. This profit is what the corporation distributes to its shareholders as dividends or keeps as retained earnings in reserves. Note that if a company does not have debt, net operating profit after tax is the same as net income after tax. 1203, 22nd Cross Rd, Sector 3, HSR Layout, Bengaluru, Karnataka 560102, The collection of taxes is the government's primary source of revenue in India. This may aid in determining the organization's development and cash flow potential in the absence of debt.

By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. Net operating profit after tax (NOPAT) measures the efficiency of a leveraged company's operations.

These factors include the sale of a product, market share value, successful advertising, changes in client preferences, firm leadership, employee training programs, sales incentive programs, seasonal variations, advertising level and effectiveness, and market competition strength. is determined on a per-share basis if the company is publicly traded, and it appears on the income statement. Costs associated with the company's product research & development. For the best experience, please upgrade to a modern, fully supported web browser. Why Is It Beneficial to Use Net Operating Profit After Tax and Not Net Income?

Inventory values are also important. Businesses need to track their profits to assess their success and possibilities for expansion. These include white papers, government data, original reporting, and interviews with industry experts. The. Some of these charges may include charges relating to a merger or acquisition, which, if considered, don't necessarily show an accurate picture of the company's operations even though they may affect the company's bottom line that year. Certain elements, like taxes, debts, and expenses, may, however, impact their profitability. Even though it is not an accurate measurement, it is frequently used as a gauge.

It is a significant criterion for shareholders to evaluate business performance. The former editor of. Wealth tax, corporate tax, and income tax are examples of, taxes, whereas excise duty, customs duty, goods and services tax, and other, taxes are examples of indirect taxes. A large profit margin translates to higher dividends for equity shareholders. Also read:Know About Paying Taxation of Income Earned From Selling Shares. Numerous factors influence a company's profits and profitability. Similarly, analysts may utilize net profit after Tax to perform additional cash flow estimates. However, unusual decreases or increases in profitability, or even losses, might occur as a result of exceptional item losses or profits.  YCharts. Mergers and acquisitions analysts use NOPAT to calculate the free cash flow to firm (FCFF) and economic free cash flow to firm. Divide the difference by the previous period's PAT, then multiply by 100. A high PAT shows that the company is profitable. It represents how well an organization's core operations performed net of profit. The net income must be reduced by expenses and costs. Divide the difference by the previous period's PAT, then multiply by 100. However, certain factors, such as taxes, debts and expenses, may affect how their profits appear. Repurchasing stock, also referred to as negative share issuance, involves holding shares in the organization's treasury. However, unusual decreases or increases in profitability, or even losses, might occur as a result of exceptional item losses or profits. After-tax operating income (ATOI) is a non-GAAP measure that evaluates a company's total operating income after taxes. PAT is determined on a share basis in the case of a publicly-traded firm, and this information is used to evaluate the value of the company's stock. "Net Operating Profit After Tax (NOPAT).". Now is the time to give it a shot! Profit after-tax, often known as net profit, is calculated by subtracting the taxable amount from PBT. A rise in the number of shares may be due to the issuance of bonus shares, the splitting of shares, the exercising of stock options, or the issuance of new equity shares. Taxation is based on PBT, and the rate of taxation is determined by the country's geographical position. is critical for understanding the actual amount that a firm makes in a given working year. Increased inventory sales will result in larger profit margins. The following are some of the deductions: Also read:All About Tax Deducted At Source. She most recently worked at Duke University and is the owner of Peggy James, CPA, PLLC, serving small businesses, nonprofits, solopreneurs, freelancers, and individuals. We also reference original research from other reputable publishers where appropriate. (Plus How To Calculate Them).css-r5jz5s{width:1.5rem;height:1.5rem;color:inherit;display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;-webkit-flex:0 0 auto;-ms-flex:0 0 auto;flex:0 0 auto;height:1em;width:1em;margin:0 0 0.25rem 0.25rem;vertical-align:middle;}.

YCharts. Mergers and acquisitions analysts use NOPAT to calculate the free cash flow to firm (FCFF) and economic free cash flow to firm. Divide the difference by the previous period's PAT, then multiply by 100. A high PAT shows that the company is profitable. It represents how well an organization's core operations performed net of profit. The net income must be reduced by expenses and costs. Divide the difference by the previous period's PAT, then multiply by 100. However, certain factors, such as taxes, debts and expenses, may affect how their profits appear. Repurchasing stock, also referred to as negative share issuance, involves holding shares in the organization's treasury. However, unusual decreases or increases in profitability, or even losses, might occur as a result of exceptional item losses or profits. After-tax operating income (ATOI) is a non-GAAP measure that evaluates a company's total operating income after taxes. PAT is determined on a share basis in the case of a publicly-traded firm, and this information is used to evaluate the value of the company's stock. "Net Operating Profit After Tax (NOPAT).". Now is the time to give it a shot! Profit after-tax, often known as net profit, is calculated by subtracting the taxable amount from PBT. A rise in the number of shares may be due to the issuance of bonus shares, the splitting of shares, the exercising of stock options, or the issuance of new equity shares. Taxation is based on PBT, and the rate of taxation is determined by the country's geographical position. is critical for understanding the actual amount that a firm makes in a given working year. Increased inventory sales will result in larger profit margins. The following are some of the deductions: Also read:All About Tax Deducted At Source. She most recently worked at Duke University and is the owner of Peggy James, CPA, PLLC, serving small businesses, nonprofits, solopreneurs, freelancers, and individuals. We also reference original research from other reputable publishers where appropriate. (Plus How To Calculate Them).css-r5jz5s{width:1.5rem;height:1.5rem;color:inherit;display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;-webkit-flex:0 0 auto;-ms-flex:0 0 auto;flex:0 0 auto;height:1em;width:1em;margin:0 0 0.25rem 0.25rem;vertical-align:middle;}.