To-date, Vistas exploration efforts have primarily focused on the Batman Deposit. Measured & Indicated Mineral Resources include Proven and Probable Reserves. View source version on businesswire.com: https://www.businesswire.com/news/home/20220207006009/en/, Pamela Solly, Vice President of Investor Relations(720) 981-1185, Boutique West Australia film festival, CinefestOZ announced its 2022 program featuring 270 film screenings and events. The effective date of the mineral resources and mineral reserves estimates is December 31, 2021. Cash Costs and AISC are non-U.S. GAAP metrics developed by the World Gold Council to provide transparency into the costs associated with producing gold and provide a comparable standard. This call will be archived and available at www.vistagold.com after February 9, 2022. For every $100 increase in gold price, the Project NPV5% increases by approximately $230 million. Cash Operating Costs consist of Project operating costs and refining costs, and exclude the Jawoyn royalty. In addition to securing the approval of the Mining Management Plan since our last technical report, we have modernized our agreement with the Jawoyn Aboriginal Association Corporation (the Jawoyn). We believe this metric reflects the operating performance potential for Mt Todd for the mining, processing, administration, and sales functions. The core zone is approximately 200-250 meters wide and 1.5 kilometers long, with several hanging wall structures providing additional width to the deposit. Contractual obligations for surface land rights (the Jawoyn Royalty) are excluded from this metric. With economics based on Q4 2021 costs, the Project is projected to deliver compelling cashflows over a 16-year mine life. In addition, Vista controls over 1,500 sq. Total recovered gold is expected to be 6.31 million ounces with average annual gold production expected to be 395,000 ounces. Years 1 - 7 start after the 6 month commissioning and ramp up period. The Companys flagship asset is the Mt Todd gold project located in the Tier 1, mining friendly jurisdiction of Northern Territory, Australia. The Los Angeles Rams revealed their Super Bowl 56 championship rings in a team ceremony Thursday night. Capital expenditures for initial and sustaining capital requirements are summarized in the following table. After-tax cash flow at a $1,800 gold price of $2.1 billion for years 1-7 of commercial operations; 19% increase in proven and probable mineral reserves, now estimated to be 6.98 million ounces of gold (280.4 million tonnes at 0.77 grams of gold per tonne (g Au/t)) at a cut-off grade of 0.35 g Au/t; life of mine grade to the grinding circuit after ore sorting of 0.84 grams of gold per tonne; Average annual life of mine production of 395,000 ounces, including average annual production of 479,000 ounces of gold during the first seven years of commercial operations; Life of mine average gold recovery of 91.6%; Average cash costs of $817 per ounce (life of mine), including average cash costs of $752 per ounce during the first seven years of commercial operations. See "Note Regarding Non-GAAP Financial Measures" below for a discussion on non-GAAP financial measures and a reconciliation to U.S. GAAP measures. Measured & Indicated Mineral Resources include Proven and Probable Reserves. See Note Regarding Non-GAAP Financial Measures below for a discussion on non-GAAP financial measures and a reconciliation to U.S. GAAP measures. Batman: Mineral resources constrained within a $1,300/oz gold Whittle pit shell. Cash Operating Costs are presented by year in the operating margin summary. The table below highlights the FS production schedule. With economics based on Q4 2021 costs, the Project is projected to deliver compelling cashflows over a 16-year mine life. Thomas L. Dyer, P.E., is the QP responsible for reporting the Batman Deposit Proven and Probable Mineral Reserves. Due to the location of the Project and its close proximity to the main NT natural gas transmission line, the Company believes that there is significant opportunity to achieve a lower natural gas price upon commitment to a long-term gas delivery contract. Similar metrics are widely used in the gold mining industry as comparative benchmarks of performance. These changes, while very conservative, significantly increased the reserve estimate from 5.85 million ounces to 6.98 million ounces. For further information, please contact Pamela Solly, Vice President of Investor Relations, at (720) 981-1185. Mineralization is open at depth as well as along strike, although the intensity of mineralization weakens to the north and south along strike. Note: Amounts may not add to totals due to rounding. Due to the location of the Project and its close proximity to the main NT natural gas transmission line, the Company believes that there is significant opportunity to achieve a lower natural gas price upon commitment to a long-term gas delivery contract. Recent drilling demonstrates the continuity of mineralization between these two deposits. Save my name, email, and website in this browser for the next time I comment. Mt Todd Gold Project - Mineral Reserves - 50,000 tpd, 0.35g Au/t cutoff and US$1,125 per ounce LG Pit. Operating costs continue to benefit from the economies of scale associated with a 50,000 tonne per day process plant, a low 2.5:1 stripping ratio (unchanged from the last technical report), and a locally-based labor force. The sum of these costs is divided by the corresponding payable gold ounces or tonnes processed to determine per ounce and per tonne processed metrics, respectively. Mt Todd Gold Production (Graphic: Business Wire), Mt Todd Operating Margin Summary (Graphic: Business Wire). Our decision to use a third-party power provider has resulted in important positive impacts to our capital costs and insulates the Project from certain construction and operating risks while maintaining what we believe to be attractive operating costs. * Years 1-7 and 8-14 are measured after the start of the 6-month commissioning and ramp up period. I would just be a hypocrite to the whole thing," Cannon said during a YouTube Live with R&B duo DVSN and sex therapist Dr. Tammy Nelson. Shares in Vista Gold jumped 11.2% by 12:30 p.m. New York time, giving the gold developer a market value of US$91.6 million. Vistas President and CEO, Frederick H. Earnest, commented, "The FS affirms the strength of Mt Todds gold production capacity and ability to deliver solid economic results at a time when inflationary pressures are having significant impacts on operating mines and development projects alike. Situated approximately 250 km southeast of Darwin, Mt Todd is the largest undeveloped gold project in Australia. We present the non-U.S. GAAP financial measures for our Project in the tables below. A conference call and webcast to discuss highlights of the FS will be held Wednesday, February 9, 2022 at 4:00 p.m. EDT (2:00 p.m. MDT). Both the Batman Deposit and Quigleys Deposit remain open. Heap Leach resources are the average grade of the heap, no cut-off applied. The Company continues to evaluate the potential use of contract mining and/or autonomous truck haulage. Pit parameters: Mining Cost $1.50/tonne, Milling Cost $7.80/tonne processed, G&A Cost $0.46/tonne processed, G&A/Year 8,201 K US4, Au Recovery, Sulfide 85%, Transition 80%, Oxide 80%, 0.2g-Au/t minimum for resource shell. Total recovered gold is expected to be 6.31 million ounces with average annual gold production expected to be 395,000 ounces. These statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Vista to be materially different from any future results, performance or achievements expressed or implied by such statements. Thomas Dyer of RESPEC is the QP responsible for developing the resource Whittle pit shell for the Batman Deposit. Vista is a gold project developer. Sabry Abdel Hafez, Ph.D., P.Eng., Rex Bryan, Ph.D., Amy Hudson, Ph.D, CPG, SME REM, April Hussey, P.E., Chris Johns, M.Sc., P.Eng., Max Johnson, P.E., , Vicki Scharnhorst, P.E., and Keith Thompson, CPG, member AIPG, on behalf of Tetra Tech, Thomas Dyer, P.E., SME REM, on behalf of Respec, Dr. Deepak Malhotra, Ph.D., SME REM on behalf of Pro Solv, LLC, Zvonimir Ponos, BE, MIEAust, CPeng, NER on behalf of Tetra Tech Proteus, are each a Qualified Person as defined under subpart 1300 of Regulation S-K under the United States Securities Exchange Act of 1934, as amended ("S-K 1300") and an independent Qualified Person as defined by Canadian National Instrument 43-101 Standards of Disclosure of Mineral Projects ("NI 43-101"), and prepared or supervised the preparation of the information that forms the basis for the scientific and technical information disclosed herein and have reviewed this press release and consented to its release. Because all the heap-leach pad reserves are to be fed through the mill, these mineral reserves are reported without a cutoff grade applied. Vista Gold(TSX: VGZ) announced on Wednesday the results of a feasibility study (FS) for its 100% owned Mt Todd gold project in the Northern Territory, Australia. The Project is designed to be a conventional, owner-operated, open-pit mining operation that will utilize large-scale mining equipment in a drill/blast/load/haul operation. This belief is in part based on local expectations of significantly increased gas reserves in the Beetaloo Basin south of Mt Todd. The scale, quality of work completed and location of Mt Todd, together with the completion of the FS and the fact that all major authorizations for development have been obtained, distinguish Mt Todd as a unique development opportunity," he added. For more information about our projects, including technical studies and mineral resource estimates, please visit our website at www.vistagold.com. Batman: Mineral resources constrained within a $1,300/oz gold Whittle pit shell. (720) 981-1185, Internet Explorer presents a security risk. Mine Planning and Design Series Whittle, Surpac, MineSched, Gems, and Simulia Isight Training, Global Meet on Power and Energy Engineering, Global Meet on Magnetism and Magnetic Materials, First Majestic to raise up to US$100M in equity offering, Caledonia Mining to buy one of Zimbabwes largest gold projects, CMC Metals geochemical survey indicates Bridal Veil polymetallic-gold potential in NL. Batman and Quigleys mineral resources are quoted at a 0.40g-Au/t cut-off grade. The table below highlights the FS production schedule. Initial capital requirements for the project are US$892 million, an 8% increase, which reflects the use of a third-party owner/operator of the power plant. Cash Costs and AISC are non-U.S. GAAP metrics developed by the World Gold Council to provide transparency into the costs associated with producing gold and provide a comparable standard. A technical report for the FS prepared in accordance with NI 43-101 disclosure standards will be filed on SEDAR and a technical report summary prepared in accordance with S-K 1300 will be filed on EDGAR with our annual report on Form 10-K, in each case, within 45 days of the date hereof and will be available on our website at that time. These measures represent costs and unit-cost measured related to the Project. Post-sorted grinding circuit feed grade (g Au/t).

While our operating costs have increased as a result of higher labor, reagent, grinding media and over-the-fence power costs, our core energy costs yield some offsetting savings. The FS also incorporates provisions of the recently approved Mt Todd Mine Management Plan, which will subsequently be amended to align with design changes in the FS. Highlights of the FS for a 50,000 tonne per day ("tpd") project include: After-tax NPV5% of $999.5 million and IRR of 20.6% at a $1,600 gold price and a $0.71 Fx rate(1); After-tax NPV5% of $1.5 billion and IRR of 26.7% at a $1,800 gold price and $0.71 Fx rate; After-tax cash flow at a $1,800 gold price of $2.1 billion for years 1-7 of commercial operations; 19% increase in proven and probable mineral reserves, now estimated to be 6.98 million ounces of gold (280.4 million tonnes at 0.77 grams of gold per tonne ("g Au/t")) at a cut-off grade of 0.35 g Au/t; life of mine grade to the grinding circuit after ore sorting of 0.84 grams of gold per tonne; Average annual life of mine production of 395,000 ounces, including average annual production of 479,000 ounces of gold during the first seven years of commercial operations; Life of mine average gold recovery of 91.6%; Average cash costs of $817 per ounce (life of mine), including average cash costs of $752 per ounce during the first seven years of commercial operations(2); Average all-in sustaining cost ("AISC") of $928 per ounce (life of mine), including average AISC of $860 per ounce during the first seven years of commercial operations; Mine life of 16 years (increase of 3 years); and. Completion of the FS represents another major step in de-risking Mt Todd and readying the Project for development. The following tables demonstrate the calculation of Cash Operating Costs, Cash Costs, AISC, and related unit-cost metrics for amounts presented in this press release. Note: Components may not add to totals due to rounding. In a first test of President Emmanuel Macron's ability to reach compromises across party lines after losing the absolute majority in recent elections, the bill next goes to the Senate, the upper house dominated by the conservative Les Republicains. Since these measures do not incorporate revenues, changes in working capital and non-operating cash costs, they are not necessarily indicative of potential operating profit or loss, or cash flow from operations as determined in accordance with U.S. GAAP. Cash costs per ounce and AISC per ounce are non-GAAP financial measures. To ensure the most secure and best overall experience on our website, we recommend the latest versions of, https://onlinexperiences.com/Launch/QReg/ShowUUID=803ED6AB-ABDC-4C7F-B282-A98D4DCB25D7, https://onlinexperiences.com/Launch/Event/ShowKey=187237, Site General and Administrative Costs per ounce, Site General and Administrative Costs per tonne processed. The Project is designed to be a conventional, owner-operated, open-pit mining operation that will utilize large-scale mining equipment in a drill/blast/load/haul operation. Six months commissioning and ramp-up period ahead of full production. Completion of the FS represents another major step in de-risking Mt Todd and readying the project for development. Deepak Malhotra is the QP responsible for reporting the heap-leach pad mineral reserves. The scale, quality of work completed and location of Mt Todd, together with the completion of the FS and the fact that all major authorizations for development have been obtained, distinguish Mt Todd as a unique development opportunity. While we believe this inflationary trend is transitory, the resilience of Mt Todd is amply demonstrated by the robust project economics reflected in the FS. View the full release here: https://www.businesswire.com/news/home/20220207006009/en/, Mt Todd Gold Production (Graphic: Business Wire). Rex Bryan of Tetra Tech is the QP responsible for the Statement of Mineral Resources for the Batman, Heap Leach Pad and Quigleys deposits. Our power plant trade-off study identified a number of highly-credentialled, well-capitalized power generating companies. We believe that these metrics help investors understand the economics of the Project. We continue to enjoy a close working relationship and their strong support for the Project. A summary of the FS results is presented in the table below. Toll-free in North America: 844-898-8648International: 647-689-4225Confirmation Code: 5074108. The sum of these costs is divided by the corresponding payable gold ounces or tonnes processed to determine per ounce and per tonne processed metrics, respectively.

Growth through exploration represents additional opportunity to add value at Mt Todd.

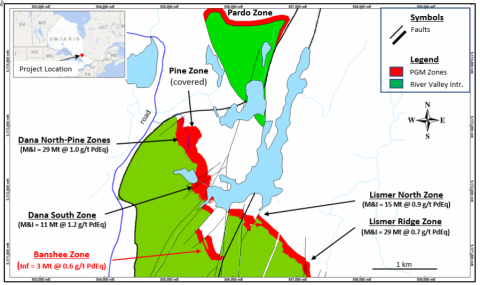

Our power plant trade-off study identified a number of highly-credentialled, well-capitalized power generating companies. km of contiguous exploration licenses at the southeast end of the Pine Creek Mining District. The economic returns reflect the increased royalty to the Jawoyn (in lieu of the previous right to a 10% direct Project ownership) as reported in November 2020. document.getElementById("ak_js_1").setAttribute("value",(new Date()).getTime()); Canadian Mining Journal provides information on new Canadian mining and exploration trends, technologies, mining operations, corporate developments and industry events. The FS uses a natural gas price comparable to other facilities that self-generate power in the NT. The average all-in sustaining cost (AISC) is US$928/oz, including average AISC of US$860/oz. Potential to convert part of the mineral resources to mineral reserves represents an opportunity to improve existing LOM economics and extend mine life. Your email address will not be published. This includes utilizing modern, proven technologies and oversizing processing equipment to best ensure throughput capacity. We believe that these metrics help investors understand the economics of the Project. The effective date of the Heap Leach, Batman and Quigleys resource estimate is December 31, 2021. Ore is planned to be processed in a comminution circuit consisting of a gyratory crusher, two cone crushers, two high pressure grinding roll crushers with primary grinding by two ball mills and secondary grinding by 10 FLSmidth VXP mills. https://onlinexperiences.com/Launch/QReg/ShowUUID=803ED6AB-ABDC-4C7F-B282-A98D4DCB25D7, Step 2 Login Page:

This includes utilizing modern, proven technologies and oversizing processing equipment to best ensure throughput capacity. All major environmental permits have now been approved. Recent drilling demonstrates the continuity of mineralization between these two deposits. https://onlinexperiences.com/Launch/Event/ShowKey=187237. Cash costs per ounce and AISC per ounce are non-GAAP financial measures. Additional drilling and metallurgical testing are required to develop mine plans and ultimately establish proven and probable mineral reserves at the Quigleys deposit. Using a gold price of $1,800 per ounce and an Fx rate of $0.71, the after-tax NPV5% is $1.5 billion and the IRR is 26.7%. Audio replay will be available for 14 days by calling toll-free in North America: 855-859-2056 or (404) 537-3406. Higher grade zones of the deposit plunge to the south.

Note: Jawoyn royalty and refinery costs calculated at $1,600 per ounce gold and $0.71 exchange rate. (CEO Video). Because the non-U.S. GAAP performance measures do not have standardized meanings prescribed by U.S. GAAP, they may not be comparable to similar measures presented by other companies. All dollar amounts stated herein are in U.S. currency and are expressed as $ unless specified otherwise. Pit parameters: Mining cost $1.90/tonne, Processing Cost $9.779/tonne processed, Royalty 1% GPR, Gold Recovery Sulfide, 82.0% and Ox/Trans 78.0%, water treatment $0.09/tonne, Tailings $0.985/tonne. Although Vista has attempted to identify important factors that could cause actual results to differ materially from those described in forward-looking statements and forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Lundin Mining targets 35% GHG emissions reduction by 2030. Additional resources are predominantly at depth and lateral along strike. These changes, while very conservative, significantly increased the reserve estimate from 5.85 million ounces to 6.98 million ounces. Components may not add to totals due to rounding. For additional information applicable to the FS, including data verification, quality assurance and control, and key assumptions; and for other matters relating to the Project, see Vistas most recent Annual Report Form 10-K as filed on EDGAR at www.sec.gov/edgar.shtml and on SEDAR at www.sedar.com. All statements, other than statements of historical facts, included in this press release that address activities, events or developments that Vista expects or anticipates will or may occur in the future, including such things as, the Companys anticipated plans for the Project, including finding potential development alternatives and the Companys focus on maximizing shareholder value and the realization of the intrinsic value of Mt Todd; our belief that Mt Todds location, scale, economics, permitting status, coupled with extensive technical work represent a unique near-term development opportunity; the results of the FS will appeal to many potential partners, investors and lenders; estimates of mineral reserves and resources; projected Project economics, including anticipated production, average cash costs, before and after-tax NPV, IRR, capital requirements and expenditures, gold recovery after-tax payback, operating costs, average tonne per day milling, mining methods procedures, estimated gold recovery, Project design, and life of mine; that the Project is an advanced stage development project; average annual production overtime; commencement of commercial production; timing for construction and commissioning; exploration of new deposits at Mt Todd and the surrounding exploration areas; ore processing plans; our belief that resource conversion and exploration during the early years of the Project will contribute to improved gold production in years 9 through 11 and further extend the mine life; potential costs or savings related to gas price; ability to convert estimated mineral resources to proven or probable mineral reserves; the estimated grade of minerals at the Quigleys deposit; ability to add higher grade feed from the Quigleys deposit to the Project in its mid years; our belief that there is a significant opportunity to achieve a lower natural gas price upon commitment to a long-term gas delivery contract; timing for and completion of the NI 43-101 technical report and the S-K 1300 technical report summary for the FS; and other such matters are forward-looking statements and forward-looking information. In addition, Vista controls over 1,500 sq. The Project also benefits from three additional years of mine life. Additional resources are predominantly at depth and lateral along strike.

Initial capital requirements of $892 million (8% increase), which reflects the use of a third-party owner/operator of the power plant. Differences in the table due to rounding are not considered material.

We continue to enjoy a close working relationship and their strong support for the Project. The technical aspects of the FS are underpinned by extensive metallurgical testing and stringent design criteria that continue to reflect Vistas rigorous approach to ensuring Mt Todd will meet design and operating specifications. Cash Operating Costs, Cash Costs, AISC and Respective Unit Cost Measures. The Company believes resource conversion and exploration during the early years of the Project will contribute to improved gold production in years 9 through 11 and further extend the life of the Project. The recently approved Mine Management Plan will be amended to align with the design changes in the FS. Dr. Deepak Malhotra has verified the metallurgical testing program and data in respect of the process improvements. Higher grade zones of the deposit plunge to the south.

The Company also has known mineral resources at the Quigleys Deposit, which is close to the planned processing plant. The Jan. 6 committee Thursday detailed testimony from Trump aides describing the president's inaction as his supporters assaulted the Capitol. The scale, quality of work completed and location of Mt Todd, together with the completion of the FS and the fact that all major authorizations for development have been obtained, distinguish Mt Todd as a unique development opportunity, he added. All foreign exchange ("Fx") rates are in U.S. dollars per Australian dollar.

Earnest concluded, Our attention will now focus more intensely on increasing shareholder value and the realization of the intrinsic value of Mt Todd. The average all-in sustaining cost (AISC) is $928/oz, including average AISC of $860/oz during the first seven years. Rex Bryan of Tetra Tech is the QP responsible for the Statement of Mineral Resources for the Batman, Heap Leach Pad and Quigleys deposits. This belief is in part based on local expectations of significantly increased gas reserves in the Beetaloo Basin south of Mt Todd. Such factors include, among others, uncertainty of mineral resource estimates, estimates of results based on such mineral resource estimates; risks relating to cost increases for capital and operating costs; risks related to the timing and the ability to obtain the necessary permits, risks of shortages and fluctuating costs of equipment or supplies; risks relating to fluctuations in the price of gold; the inherently hazardous nature of mining-related activities; potential effects on Vistas operations of environmental regulations in the countries in which it operates; risks due to legal proceedings; risks relating to political and economic instability in certain countries in which it operates; as well as those factors discussed under the headings Note Regarding Forward-Looking Statements and Risk Factors in Vistas most recent Annual Report Form 10-K as filed on EDGAR at www.sec.gov/edgar.shtml and on SEDAR at www.sedar.com. Differences between Batman and Quigleys mining and metallurgical parameters are due to their individual geologic and engineering characteristics. Using a gold price of $1,800 per ounce and an Fx rate of $0.71, the after-tax NPV5% is $1.5 billion and the IRR is 26.7%. Vista plans to recover gold in a conventional carbon-in-pulp recovery circuit. The average cash costs over life of mine is estimated at US$817/oz, including average cash costs of US$752/oz during the first seven years of commercial operations. Components may not add to totals due to rounding. Gold mineralization in the Batman Deposit occurs in sheeted veins within silicified greywackes/shales/siltstones. Asher-Smith finished behind Jamaica duo Shericka Jackson and Shelly-Ann Fraser-Pryce.

Initial capital costs increased 8% and benefited from savings associated with a favorable trade-off study that supports using a third-party power provider to build, own and operate the power plant at only modestly higher power costs to the Project. during the first seven years and 395,000 oz. Shares in Vista Gold jumped 11.2% by 12:30 p.m. New York time, giving the gold developer a market value of $91.6 million. Initial capital requirements for the project is $892 million, an 8% increase, which reflects the use of a third-party owner/operator of the power plant.

This press release contains forward-looking statements within the meaning of the U.S. Securities Act of 1933, as amended, and U.S. Securities Exchange Act of 1934, as amended, and forward-looking information within the meaning of Canadian securities laws. The effective date of the mineral resources and mineral reserves estimates is December 31, 2021. Management placed a high priority on controlling capital costs while maintaining the operating cost benefits of a large-scale project.

The average cash costs over life of mine is estimated at $817/oz, including average cash costs of $752/oz during the first seven years of commercial operations. The Company also has known mineral resources at the Quigleys Deposit, which is close to the planned processing plant.

Site General and Administrative Costs per ounce, Site General and Administrative Costs per tonne processed. View Entire Post . (Bloomberg) -- Gold slipped after posting its biggest gain in more than a month as the US dollar edged up, with investors weighing renewed concerns over economic growth amid tightening monetary policy.Most Read from BloombergAmericans Who Cant Afford Homes Are Moving to Europe InsteadMusk Lieutenant Scrutinized in Internal Tesla Purchasing ProbeThese Are the Worlds Most (and Least) Powerful Passports in 2022Biden Contracts Covid as Pandemic Shows Its Staying PowerEx-Coinbase Manager Arrested i. Cash Operating Costs consist of Project operating costs and refining costs, and exclude the Jawoyn royalty. Years 16 and 17 process Heap Leach ore after the pit ore is exhausted. Post-sorted grinding circuit feed grade (g Au/t).

Pamela Solly, Vice President of Investor Relations